If you’re an entrepreneur running a startup, chances are bookkeeping isn’t your favorite part of the job. Nevertheless, efficient financial management is crucial to the success of your business, so finding bookkeeping services that keep operations on track will help you focus on the things you do best—like serving customers and growing your company.

While AI-powered bookkeeping services have gained popularity recently, startups often find themselves in need of personalized attention, expert guidance, and a human touch that AI simply cannot provide.

However, many startups do not have the resources to hire an in-house bookkeeper, chief financial officer, and dedicated accountant. Therein lies the advantage of online bookkeeping services, providing access to high-quality bookkeeping without resorting to expensive traditional options or dubious AI account software. Or, potentially even worse.. doing their own bookkeeping.

In this guide, we’ll delve into an updated list of top providers of virtual bookkeeping services with fresh options for 2025. Helping startups make informed decisions about their bookkeeping needs, they provide detailed financial records, monthly financial statements and reports, as well as budget assistance.

We’ll also feature Reel Unlimited, which provides design services tailored to startups—a great solution for brands hoping to complement their financial management efforts with compelling branding to foster rapid growth.

Why your Startup Needs an Online Bookkeeping Service

Considering which avenue to pursue when finding bookkeeping services, it’s important to consider your company’s unique needs. Here are some of the reasons why an online bookkeeping service should be one of your top considerations:

Personalized attention

Being in a critical growth stage, startups have unique challenges and opportunities that require personalized financial guidance and insight. It may sound cliché, but no two startups are the same: and therefore neither are their needs when it comes to financial advice.

Automated systems may appear to provide value, but they fall short in their ability to address the specific needs of startups. Human-powered bookkeepers can listen to your challenges, collaborate, and provide solutions tailored to the intricacies of your exact financial situation.

In the long run, the personalized touch provides greater value and better future-proofs your business through strategic long-term planning.

Expertise and guidance

Human-powered bookkeeping services are about more than just data entry. They offer expert advice, guidance, and support tailored to your specific needs, backed by years of experience.

When it comes to major financial decision-making, being as informed as possible is paramount. With the expertise provided by bookkeeping services, you’ll be able to tackle complex financial scenarios knowing you’re doing so based on informed choices aligned with your strategic goals.

Compliance and accuracy

Good bookkeeping doesn’t mean relying on a big filing cabinet full of crumpled receipts. Professional bookkeepers ensure your business has accurate financial records, and ensure operations are in compliance with all the nebulous, ever-changing regulations they may be subject to.

Not only does good compliance and accuracy ensure smooth operations, but it also mitigates risk in case of unforeseen obstacles. With your financial records taken care of accurately, you can confidently focus on core activities instead.

Choosing the Best Online Bookkeeping Service

Online bookkeeping services offer small business owners everything from accounting services, tax services, tax prep, and tax advice—in other words, most things small businesses need to ensure their cash flow is in order.

So, if deciding to forgo the traditional route of building an in-house team, how does one choose from the many services available? Here are a few attributes to look out for:

Range of services

When deciding which service to hire, it’s crucial to look for one that offers comprehensive service. Beyond basic bookkeeping services, consider a provider that offers tax filing services, tax prep, financial reports, and advisory services.

A full-service bookkeeping provider can create efficiency for your business—a one-stop-shop for small business finances, where you save time and money by taking a holistic approach to managing your money.

Target market

Consider the target market the service provides in order to make sure it’s aligned with the needs and stage of your startup. As a small business owner, not all accounting firms may be tailored to your niche.

Some services may cater to small businesses and bootstrap startups, while others specialize in pre-revenue ventures or companies in certain industry sectors.

Small businesses that choose a service tailored to their specific needs ensure better scalability, flexibility, and are more likely to receive relevant advice.

Pricing

Determine the best fit for your current budget and anticipated growth trajectory by taking a careful look at pricing structures. After all, it’s not just about where your budget is at now, but where it projects to be in the future.

Look for bookkeeping services that offer transparent pricing and scalable options so you can accommodate for your startup’s changing needs as it grows and adapts to market changes.

Startup suitability

Similar to the target market, assess whether the service caters to your company in its current state. Does the service mainly deal with early-stage ventures, or does it focus on high-growth companies?

Scalability and flexibility are crucial, so your bookkeeping provider should be able to adapt and grow with your startup, providing continuous support along the way.

Best Online Bookkeeping Services for Startups in 2025

1. Fondo

Fondo is a bookkeeping service for startups, providing tax services and tax credits. They provide all-in-one accounting starting at $499 per month.

2. Bench

Bench, America’s largest bookkeeping company for small business, uses its own accounting software, saving startups from paying for separate subscriptions. Startups can access their financial data even after canceling their Bench subscription, making it an excellent choice for small businesses. Bench offers pricing options starting at $249 per month (billed annually) or $299 monthly.

3. Kruze Consulting

Kruze Consulting is an online provider of accounting, CFO, tax, and HR services for startups. Working with Seed, Series A, and Series B startups, they offer outsourced bookkeeping starting at $600 per month.

4. Pilot

Pilot provides back-office services, including bookkeeping, controller, and CFO services. Pilot is designed for startups with high-growth potential and works well for companies with strong financial backing. Pilot plans start at $499 per month. The price of Pilot’s services increases as the business grows, so startups need to keep track of the monthly cost.

5. Bean Ninjas

Tailored to ecommerce companies, Bean Ninjas offers bookkeeping, sales tax collection, and financial reporting for scaling 7- and 8-figure small businesses.

6. Cleartax

Cleartax is India’s largest tax and financial services accounting software platform. With services ranging from tax consulting to accounts receivable, they offer solutions for both individuals and small business owners.

7. Accountalent

Accountalent provides unlimited, comprehensive income tax, bookkeeping, R&D study, and financial services for startups and small business owners. Bookkeeping services start at $199 per month, and dedicated CPA support is $2,450 per year.

8. FlowFI

FlowFi is an accounting startup that matches small businesses with finance experts to assist with their financial statements and other accounting needs. Aimed at startup growth, FlowFi provides access to CFO, accounting, and tax professionals.

9. Inkle

Inkle is a US-based tax and bookkeeping automation accounting software platform for startups. Designed to replace your existing CPA and perform state and federal filings, Inkle offers basic tax services for $30 per month.

10. Rillet

Rillet is an accounting platform for SaaS and usage, providing automated reporting and SaaS metrics for accounting teams, finance firms, and founders. Plans start at $199 per month along with a 30-day free trial.

11. Graphite Financial

Graphite Financial is an accounting service for early-stage and high-growth companies. Providing accounting, strategy, and tax preparation services, their plans start at $900 per month.

12. Zinance

Zinance is an online accounting service that syncs your business products with popular finance software, thereby streamlining workflow and ensuring compliance. Plans start at $179 per month and can be customized for US-based or international companies.

13. Finta

Finta is an accounting platform designed to allow founders and startup operators to manage their taxes, bookkeeping, and financial statements. Plans begin at $100 per month with additional add-on features available.

14. Less Accounting

Billing itself as the “world’s simplest bookkeeping software,” Less Accounting is an accounting platform for startups to record business expenses, send invoices, and manage accounts receivable. Plans begin at $24 per month along with a free trial.

15. Bookkeeper360

Bookkeeper360 is an accounting service for small- to medium-sized businesses that provides payroll, tax, and CFO advisory solutions. Monthly services start at $399 per month, with pay-as-you-go options also provided.

16. Punch Financial

Punch Financial offers “high-level financial strategy and accounting services for bookkeeping prices.” Designed to replace hiring an in-house CFO, they offer services starting at $1,500 per month.

17. Manay CPA

Manay CPA is a full-service accounting and tax service platform, providing new business formation expertise, CPA services, accounting and tax planning.

18. QuickBooks Live Bookkeeping

QuickBooks Live Bookkeeping is an online bookkeeping service from Intuit, the makers of the popular bookkeeping, tax, and financial software QuickBooks, TurboTax, and Credit Karma. Connecting customers to verified virtual bookkeepers, their platform starts at $15 per month for their assisted bookkeeping services and $300 per month for their Full-Service Bookkeeping.

19. Tukel, Inc.

Tukel, Inc. offers bookkeeping, reporting, and tax services for online business owners, SaaS, and e-commerce companies. Plans start at $389 per month with custom plans also available.

20. Fincent

Fincent is an accounting platform that combines software with certified bookkeepers to help US-based businesses manage their finances. Plans start at $299 per month based on your company’s monthly expenses.

21. Acuity (Bonus)

Acuity offers advanced virtual bookkeeping and accounting services through tiered subscriptions, each providing a dedicated bookkeeper and unique quarterly CFO insights. For startups seeking a finance expert, Acuity’s premium plan includes a virtual bookkeeper, account manager, tax services, and monthly CPA meetings. Prices start at $449 for bookkeeping and $2,209 for combined bookkeeping and accounting, with custom plans available.

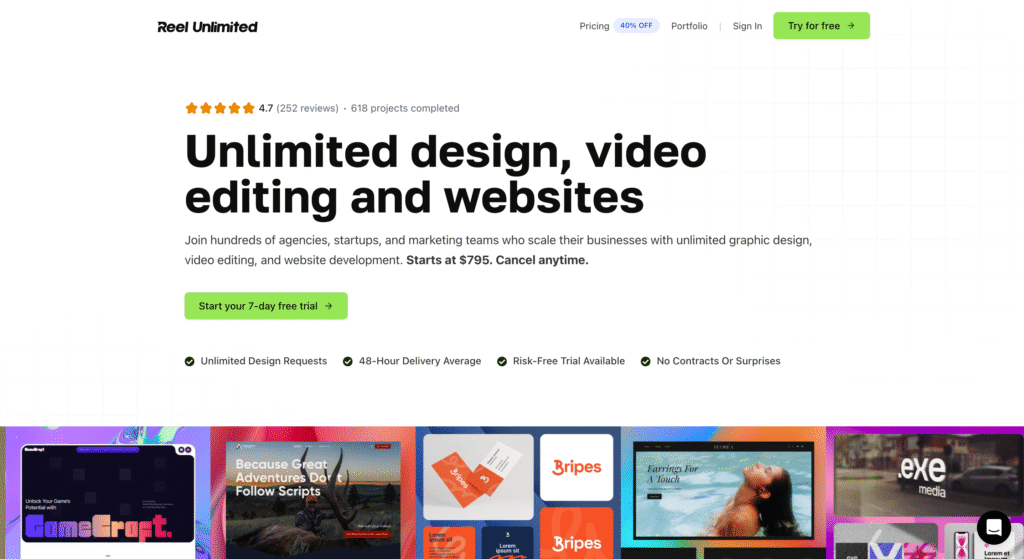

Introducing Reel Unlimited

While managing your startup’s finances requires professional bookkeeping services, building a strong brand presence is equally important for long-term success. Reel Unlimited provides unlimited design services that help startups create professional branding without the overhead of hiring internal design staff.

Founded in 2021, Reel Unlimited has served hundreds of clients including SquareDash, Synthesia, Pattern, and Outmin. We understand that startups need professional design work but often lack the budget for expensive agency relationships or the time to manage multiple freelancers.

Our human design team creates everything your startup needs – logos, websites, marketing materials, social media graphics, and video content. All work is done by professional designers, not AI or templates, ensuring your brand stands out in competitive markets.

Two ways to work with us

30-day services work perfectly for startups with specific launch deadlines or campaign periods. Get unlimited design work for exactly 30 days with no subscription or recurring billing. Perfect for product launches, rebrands, or seasonal campaigns.

Monthly subscriptions provide better value for startups with ongoing design needs. Save money compared to 30-day services while getting additional features like white-label capabilities for agencies and priority support.

Service options for growing startups

Graphics: Unlimited graphic design including logos, branding, social media content, presentations, marketing materials, and video editing with 2 concurrent projects.

Websites: Complete website design and development on Webflow with 1 concurrent project. From initial design to final launch, we handle everything.

Bundle: Combined graphics and website services with 3 concurrent projects total. Best value for comprehensive branding needs.

Why startups choose Reel Unlimited

Having a strategic approach to both financial management and visual brand presence helps startups differentiate themselves in competitive markets. Professional design builds credibility with investors, customers, and partners while consistent branding supports marketing and sales efforts.

Unlike traditional design agencies that require large retainers and long-term contracts, our model provides immediate access to professional design work at predictable monthly rates. This allows startups to allocate resources efficiently while maintaining professional brand standards.

Start your 7-day trial to experience our design quality with one completed project, or explore our pricing to see which service option matches your startup’s needs and budget.