Design subscription for growing businesses

Reel Unlimited is the design subscription service that helps agencies, startups and marketing teams scale their businesses with unlimited designs, video editing and websites. Starts at $795. Cancel anytime.

- Built-in NDA protection

- 4 concurrent projects running

- 48-hour average delivery

- No contract, cancel anytime

- 4 concurrent projects running

- 48-hour average delivery

- No contract, cancel anytime

- Built-in NDA protection

- 4 concurrent projects running

- 48-hour average delivery

- No contract, cancel anytime

- Built-in NDA protection

- 4 concurrent projects running

- 48-hour average delivery

- No contract, cancel anytime

- Unlimited Design Requests

- 48-hour delivery average

- Risk-free trial available

- No contracts or surprises

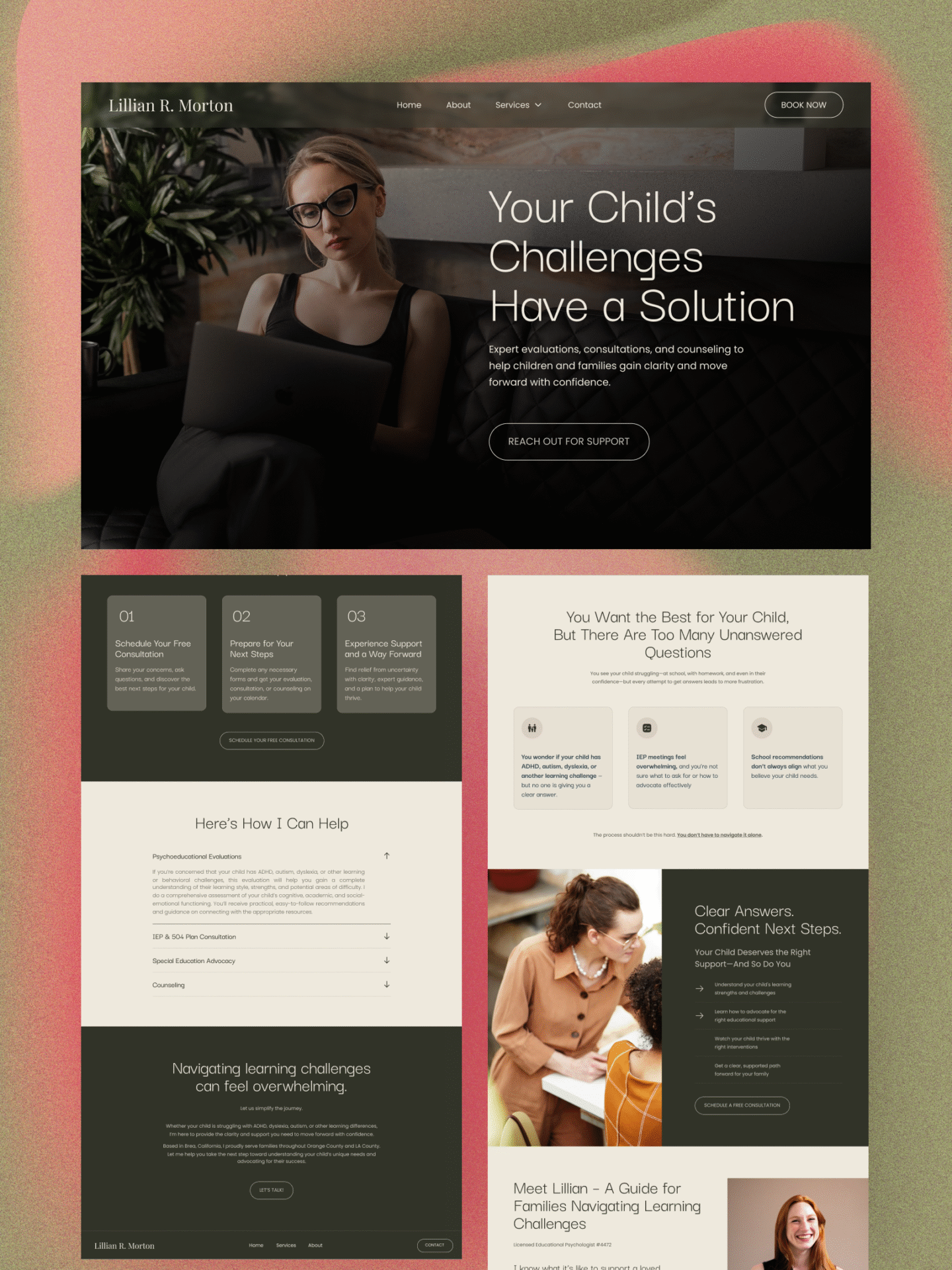

How Reel Unlimited works

Choose your service

Select Graphics, Websites, or Bundle based on your business needs.

Submit your requests

Submit unlimited design requests through your dedicated client portal.

Receive your work

Get your designs back in 48 hours average, websites in 3-5 days.

Approve and download

Review, approve, and download your designs or launch your website.

What you get with Reel Unlimited

Reel Unlimited provides conversion-proven websites, eye-catching branding, stunning graphics, and engaging video content with fast delivery.

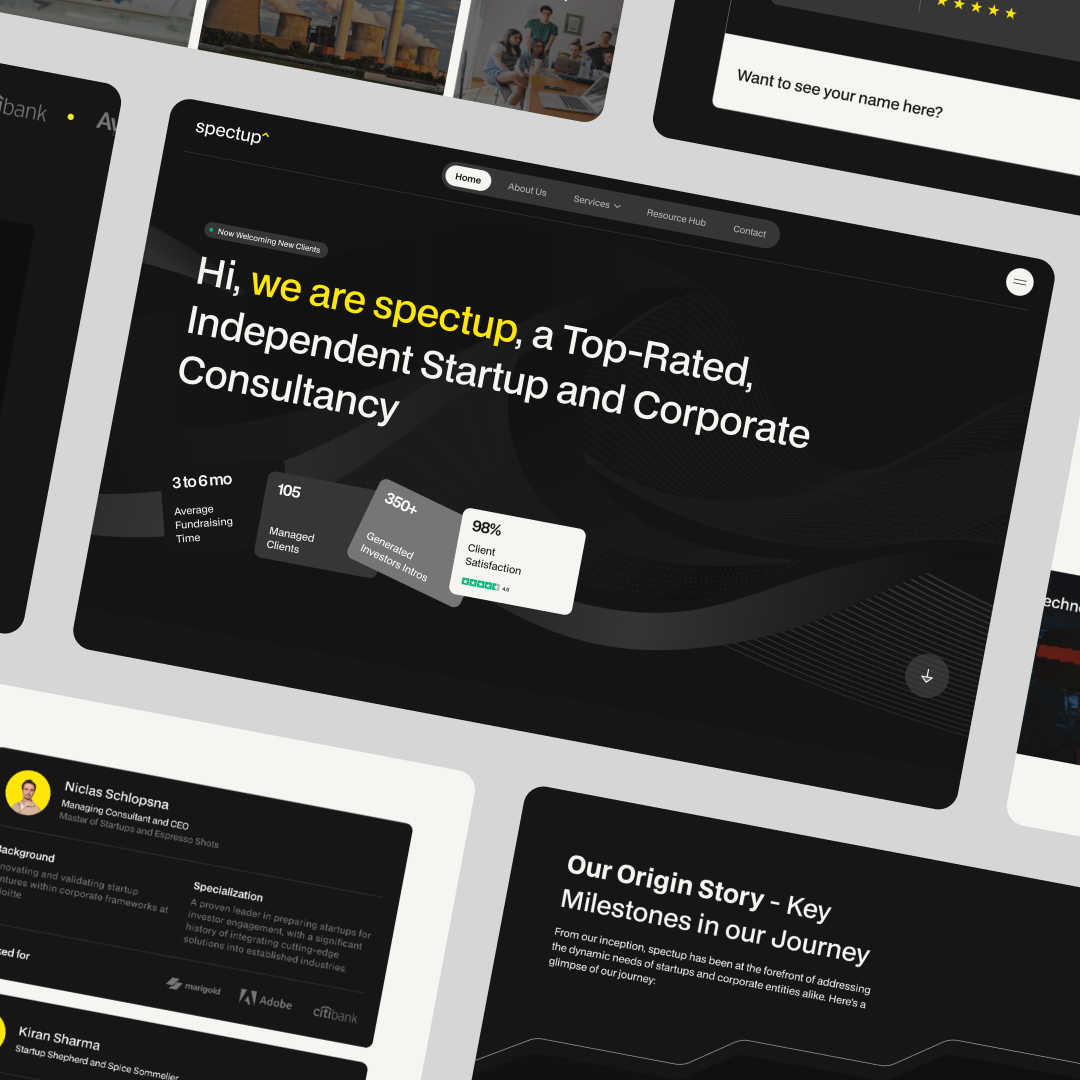

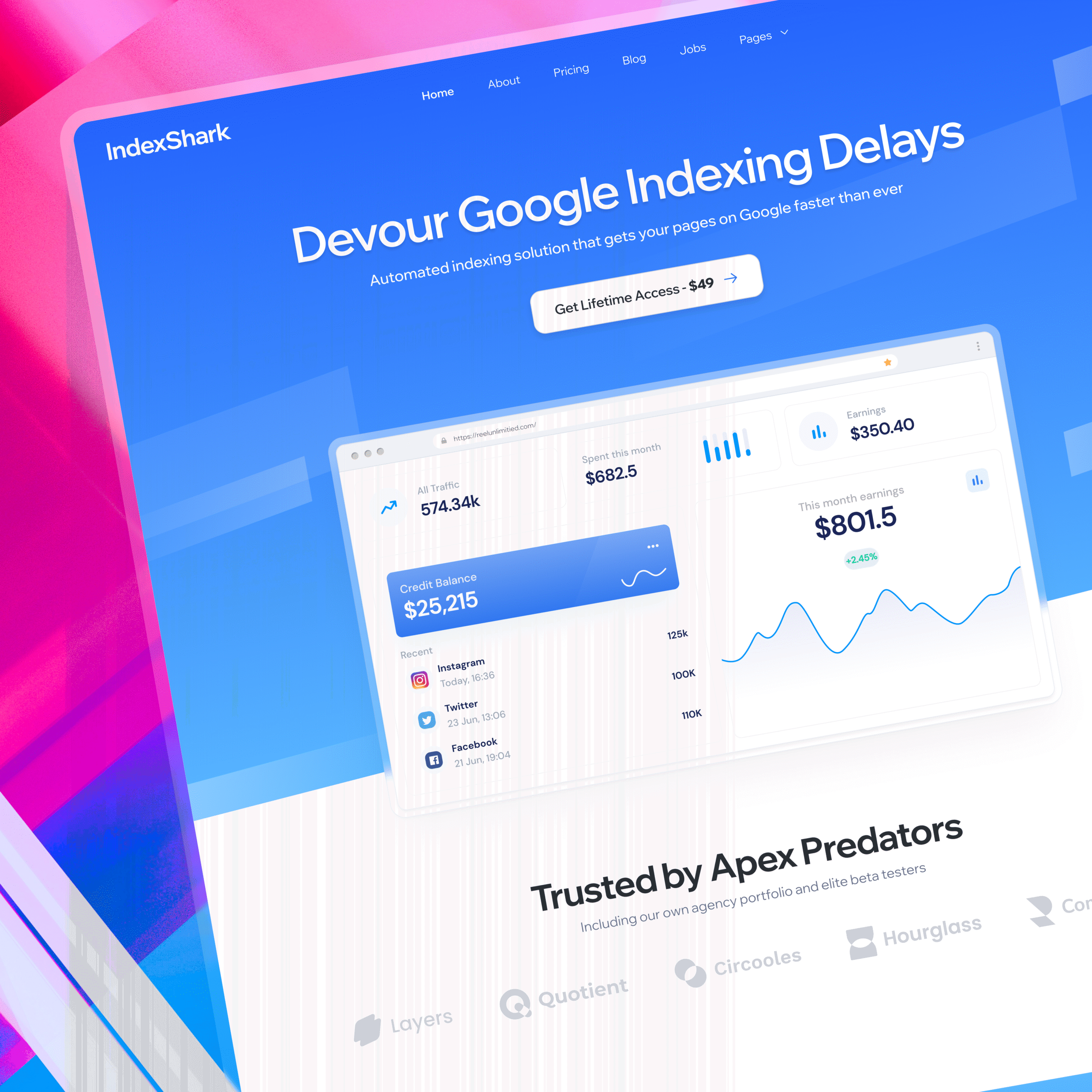

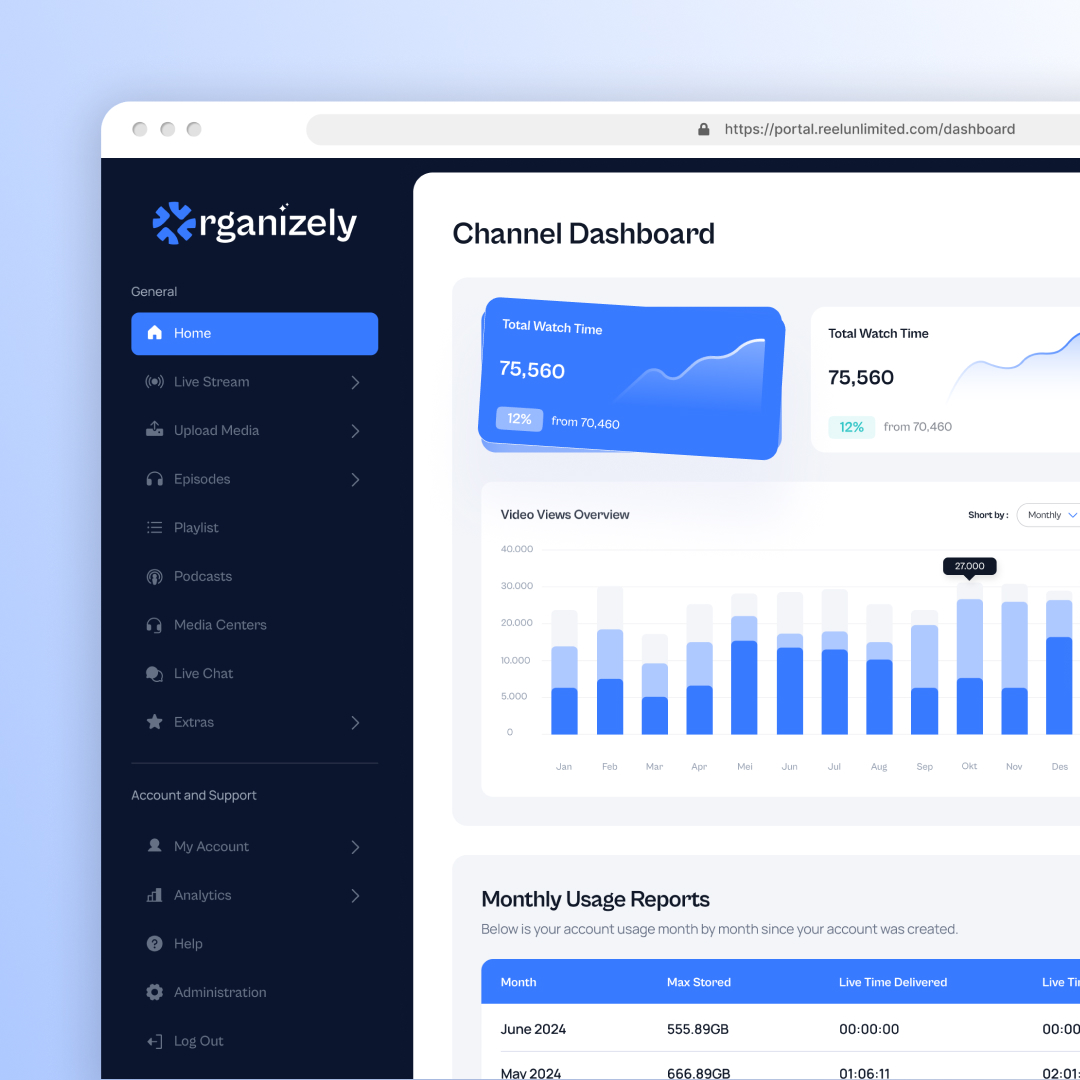

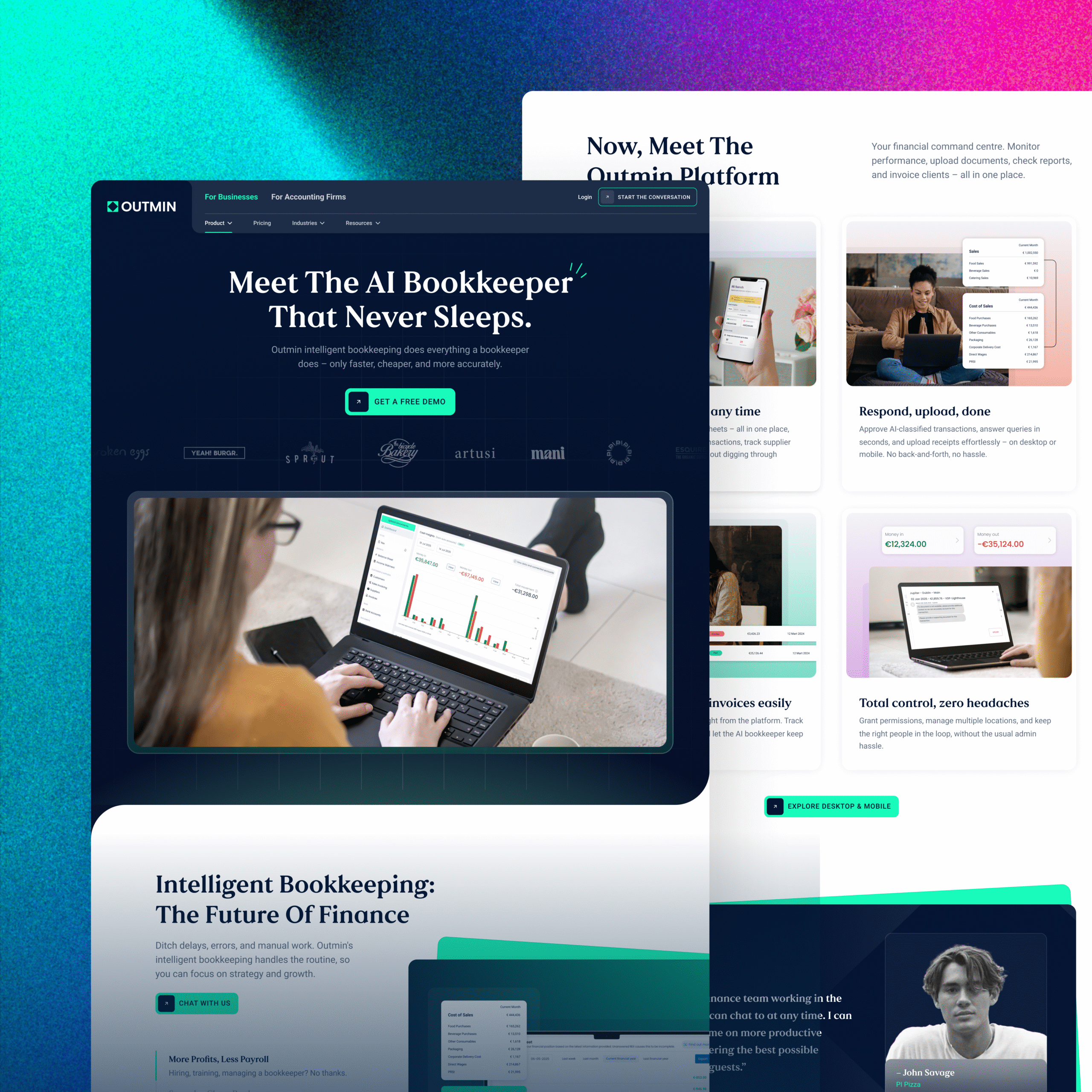

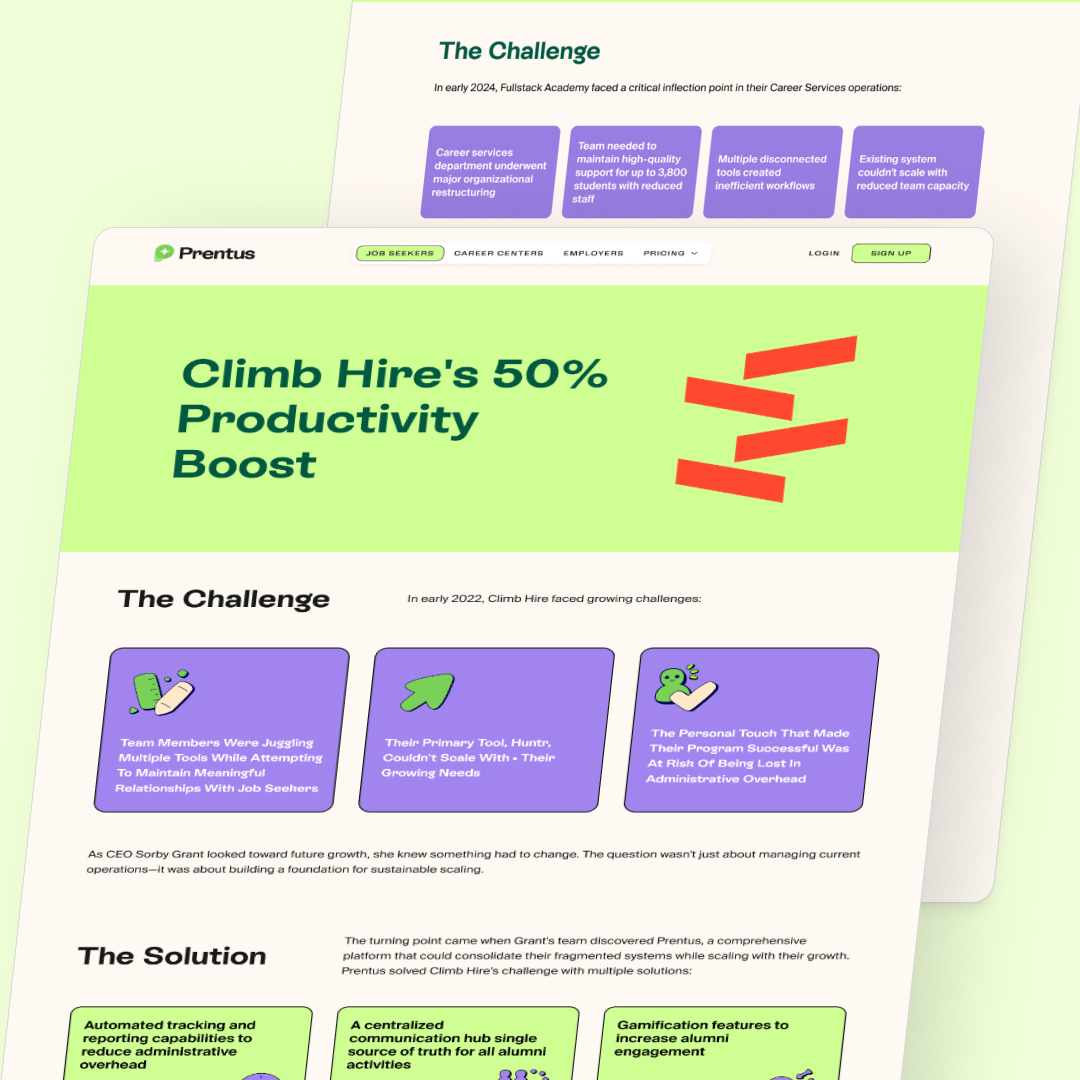

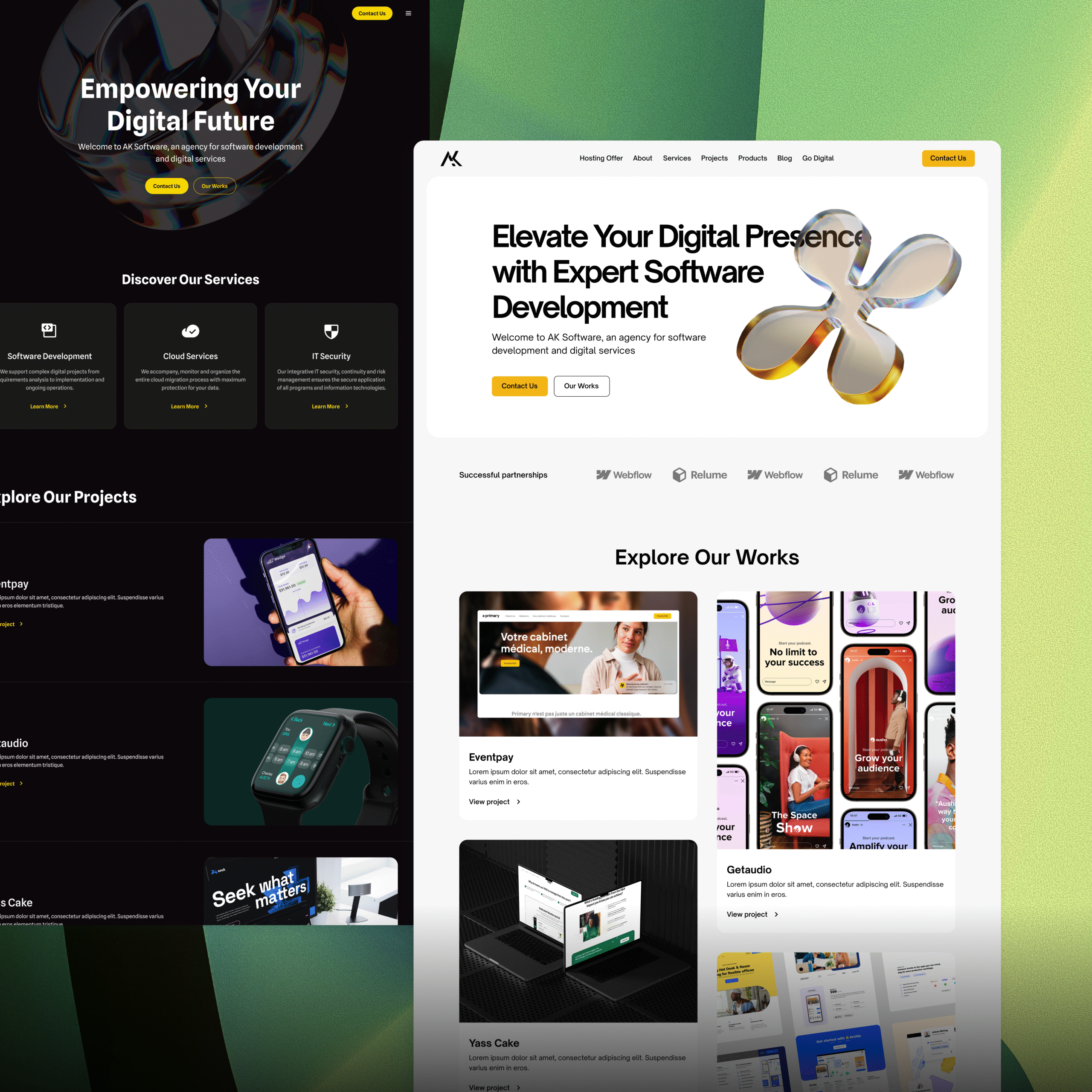

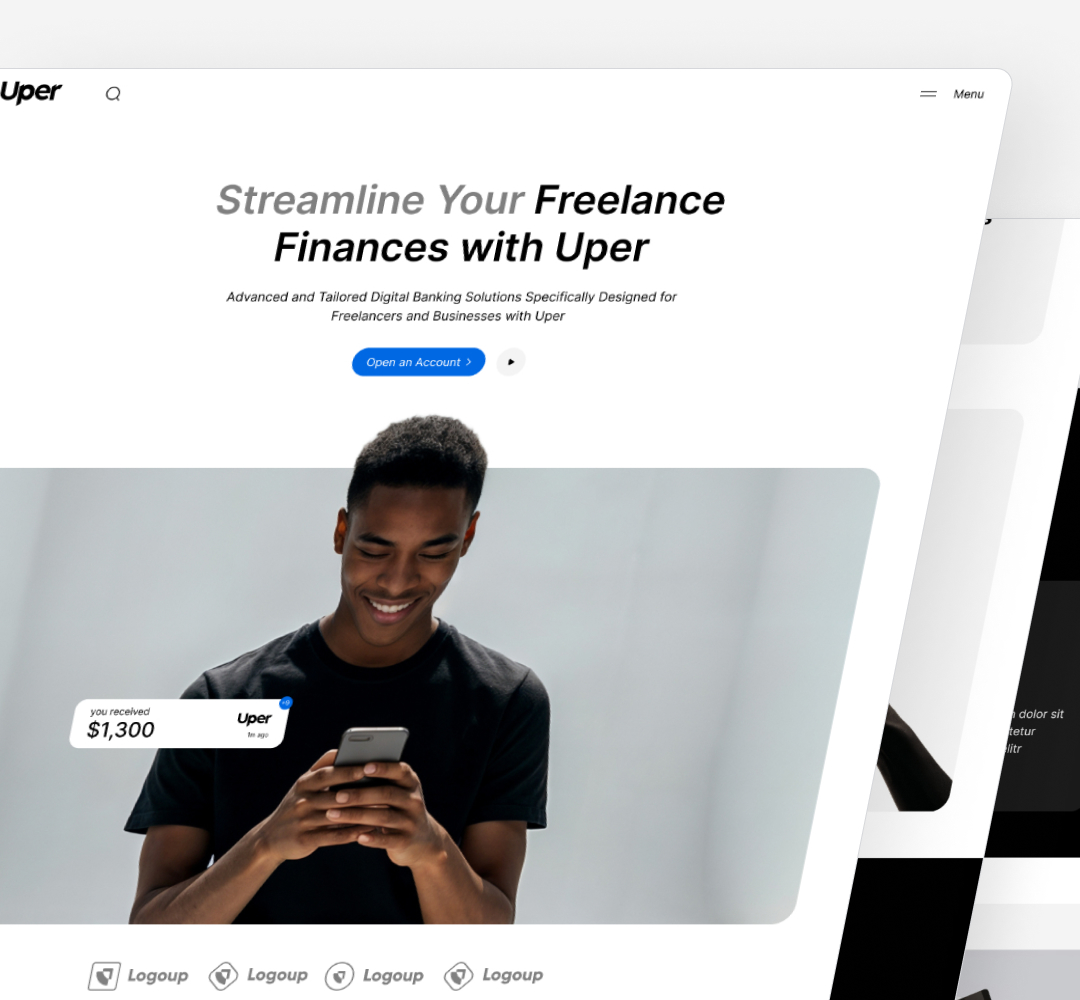

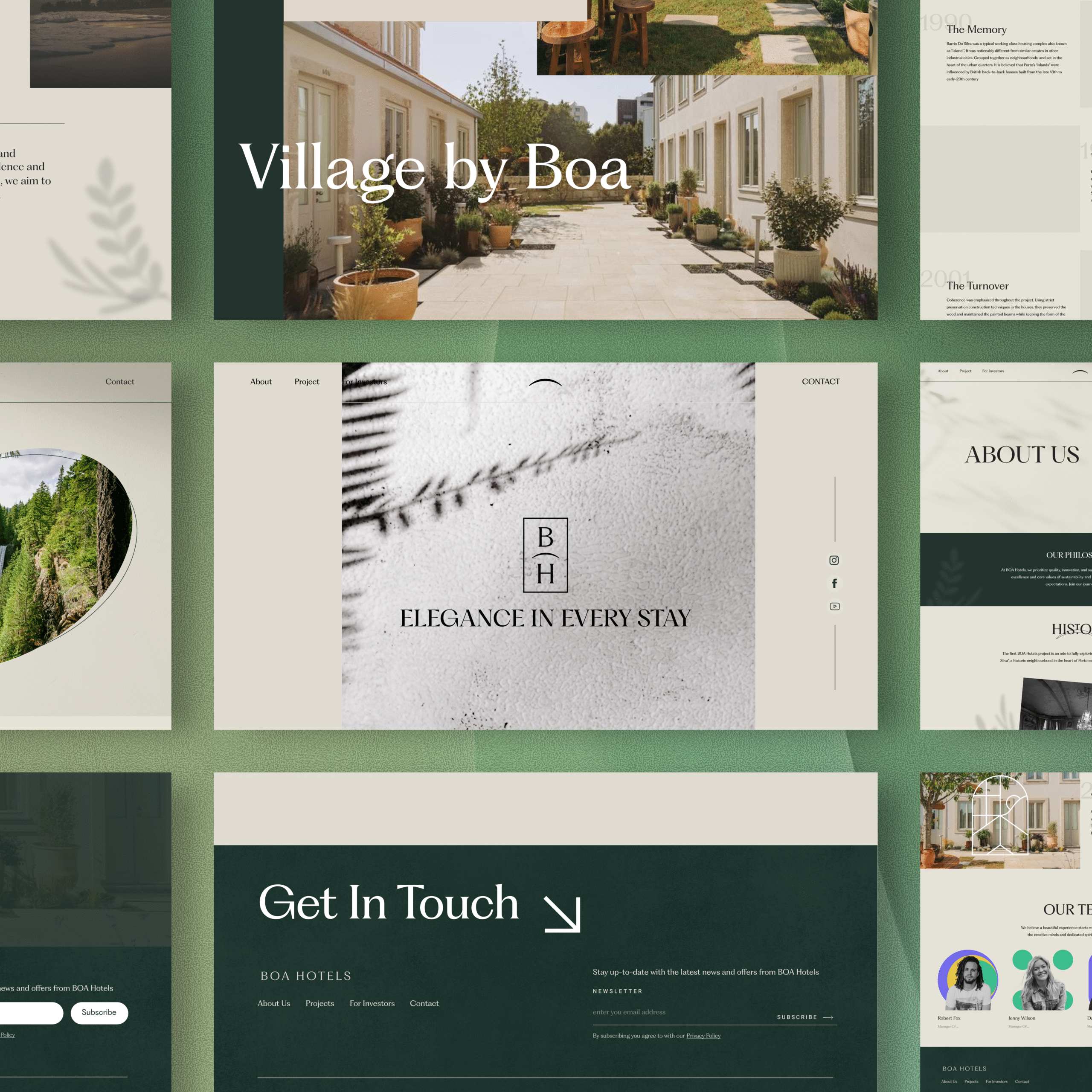

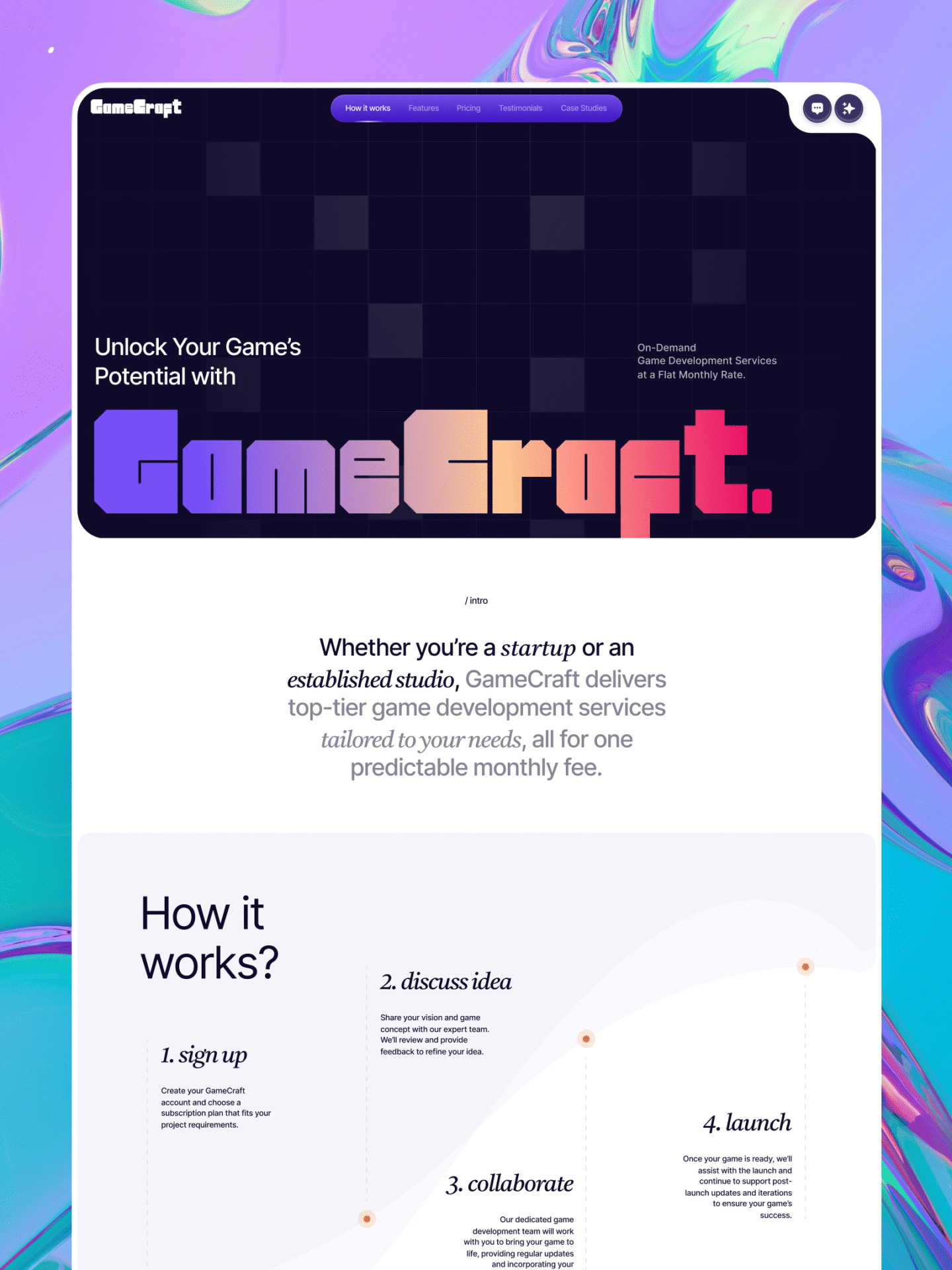

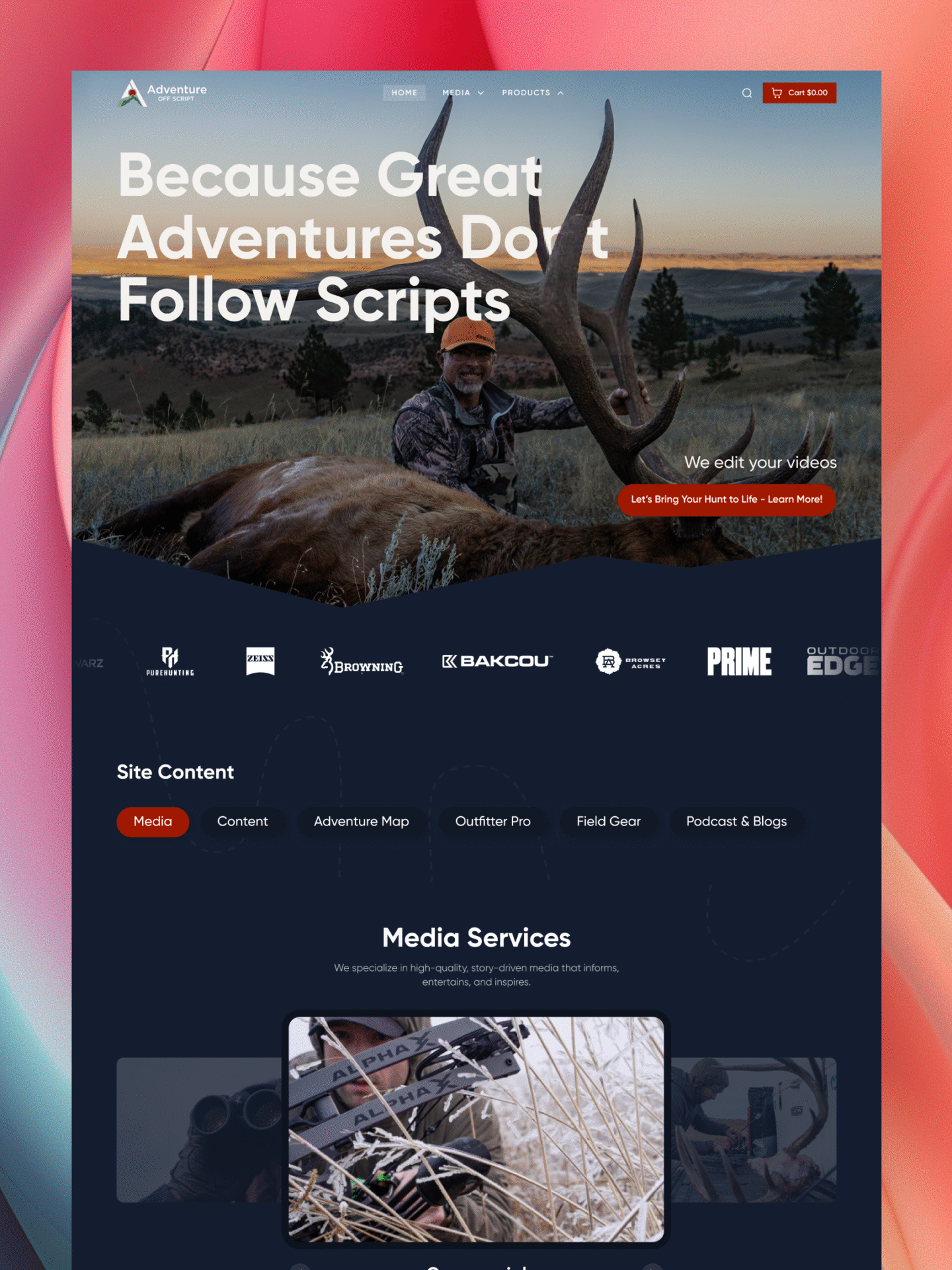

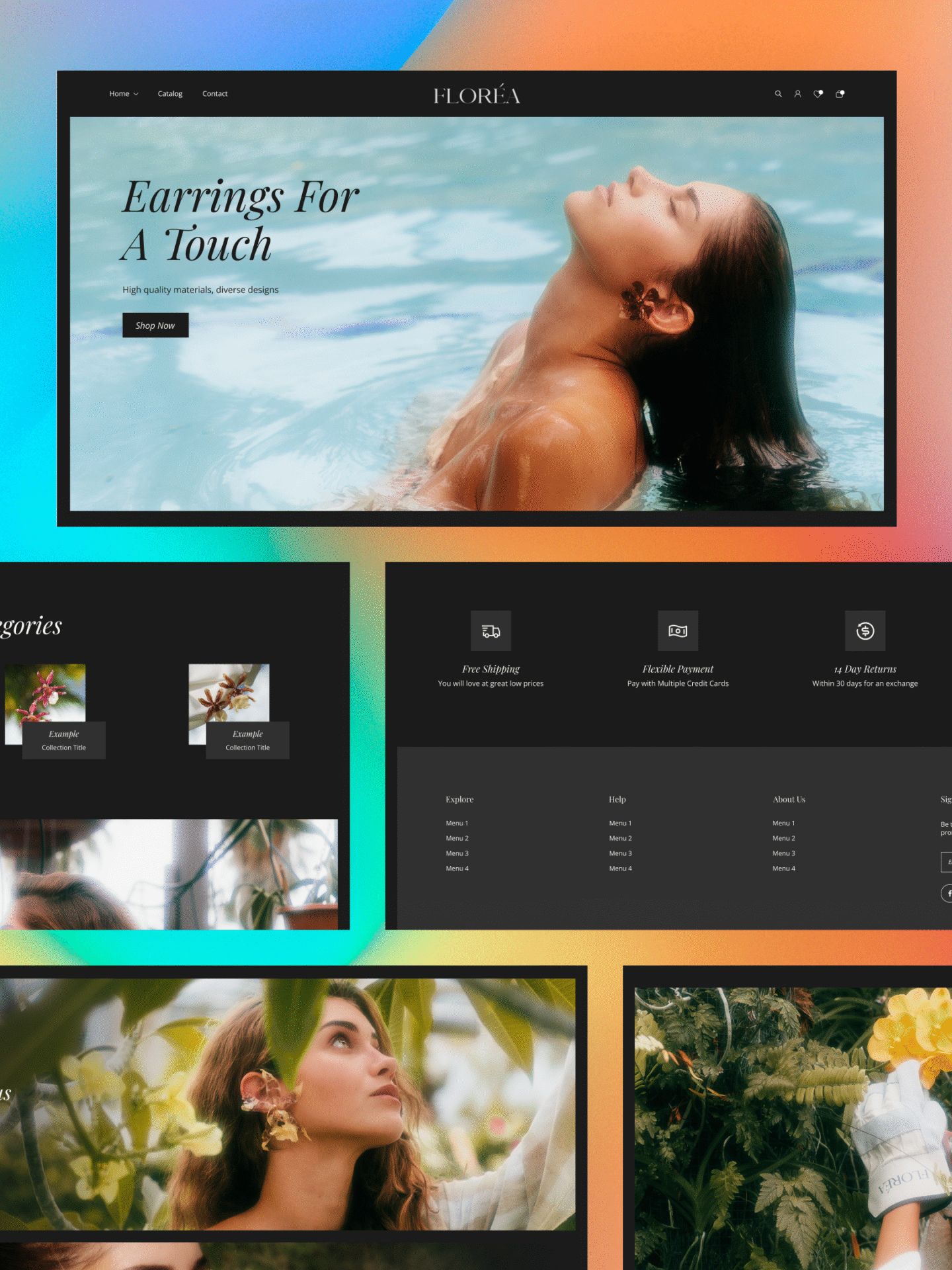

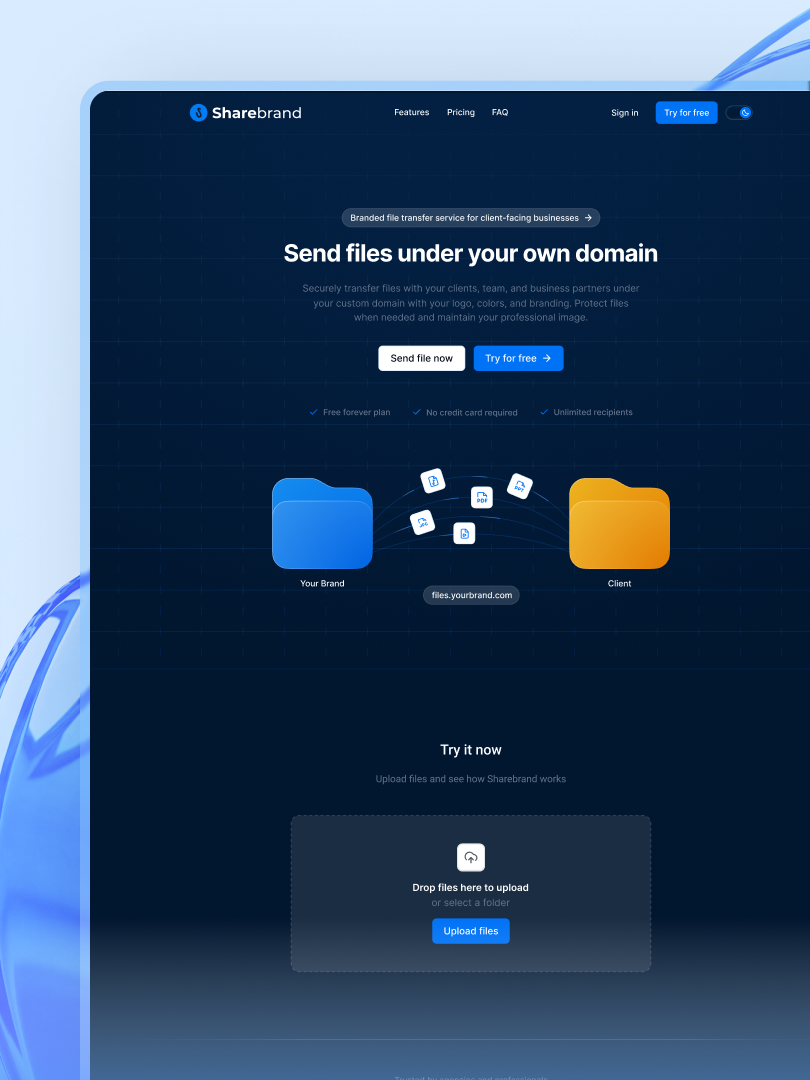

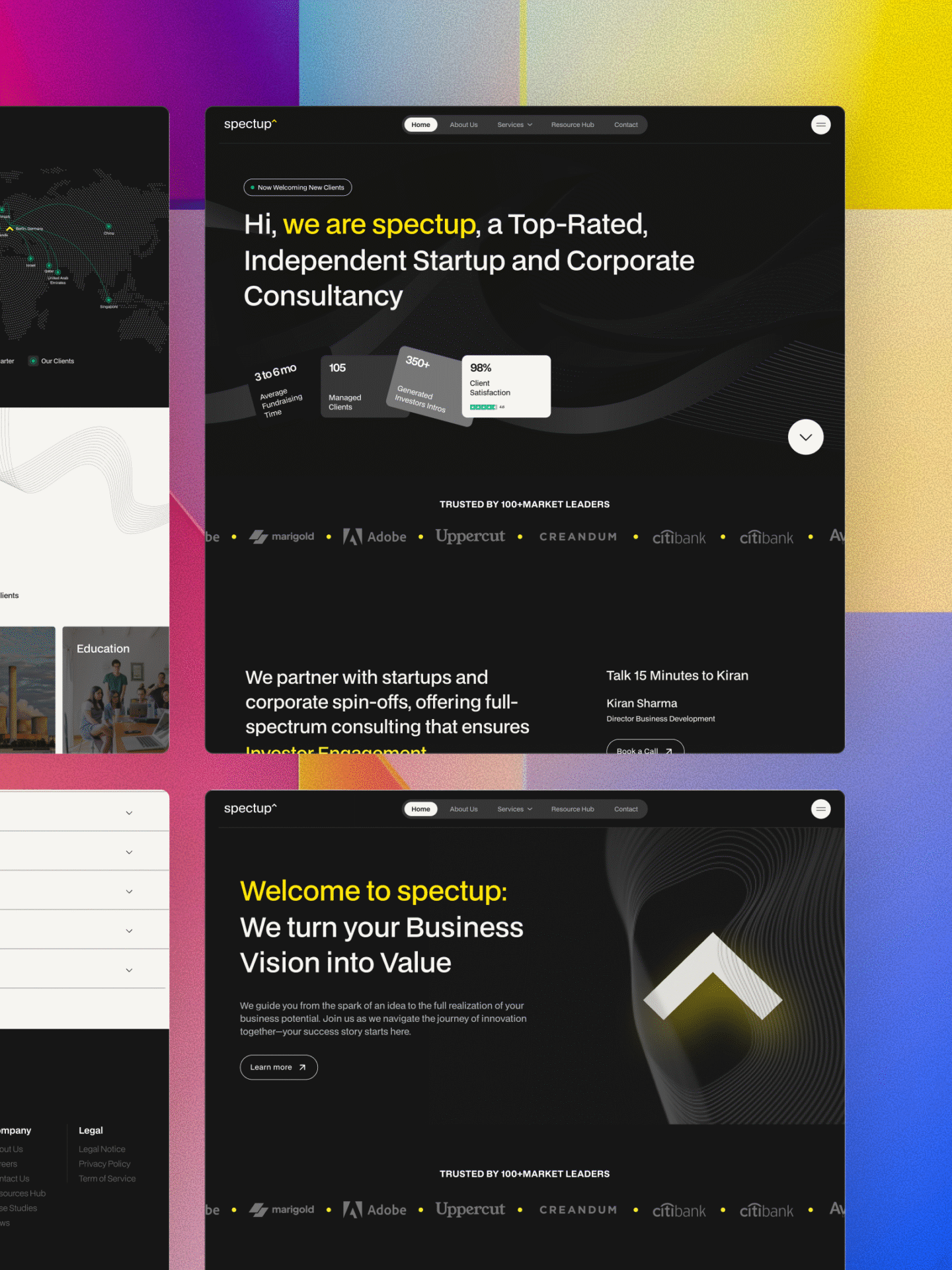

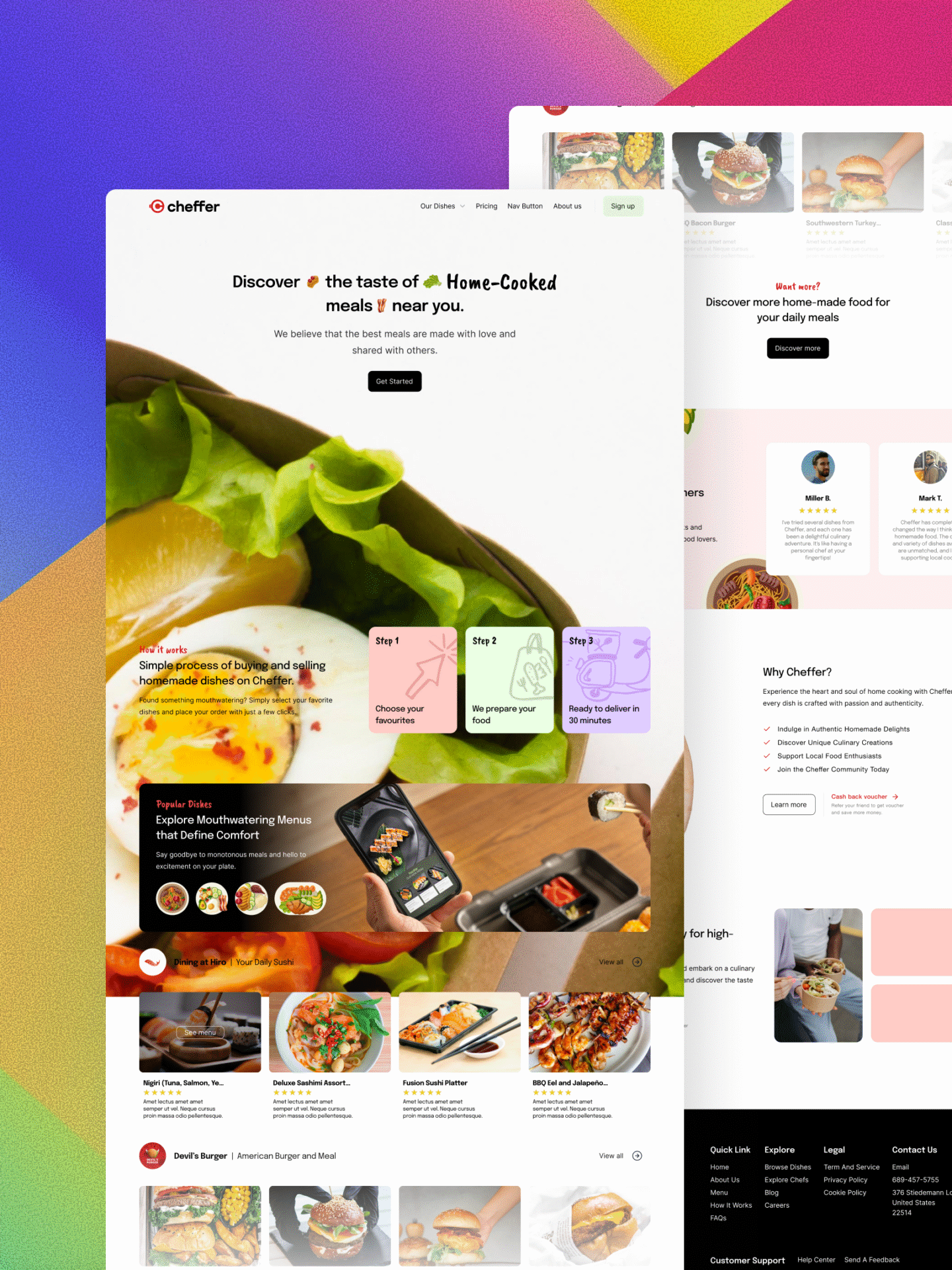

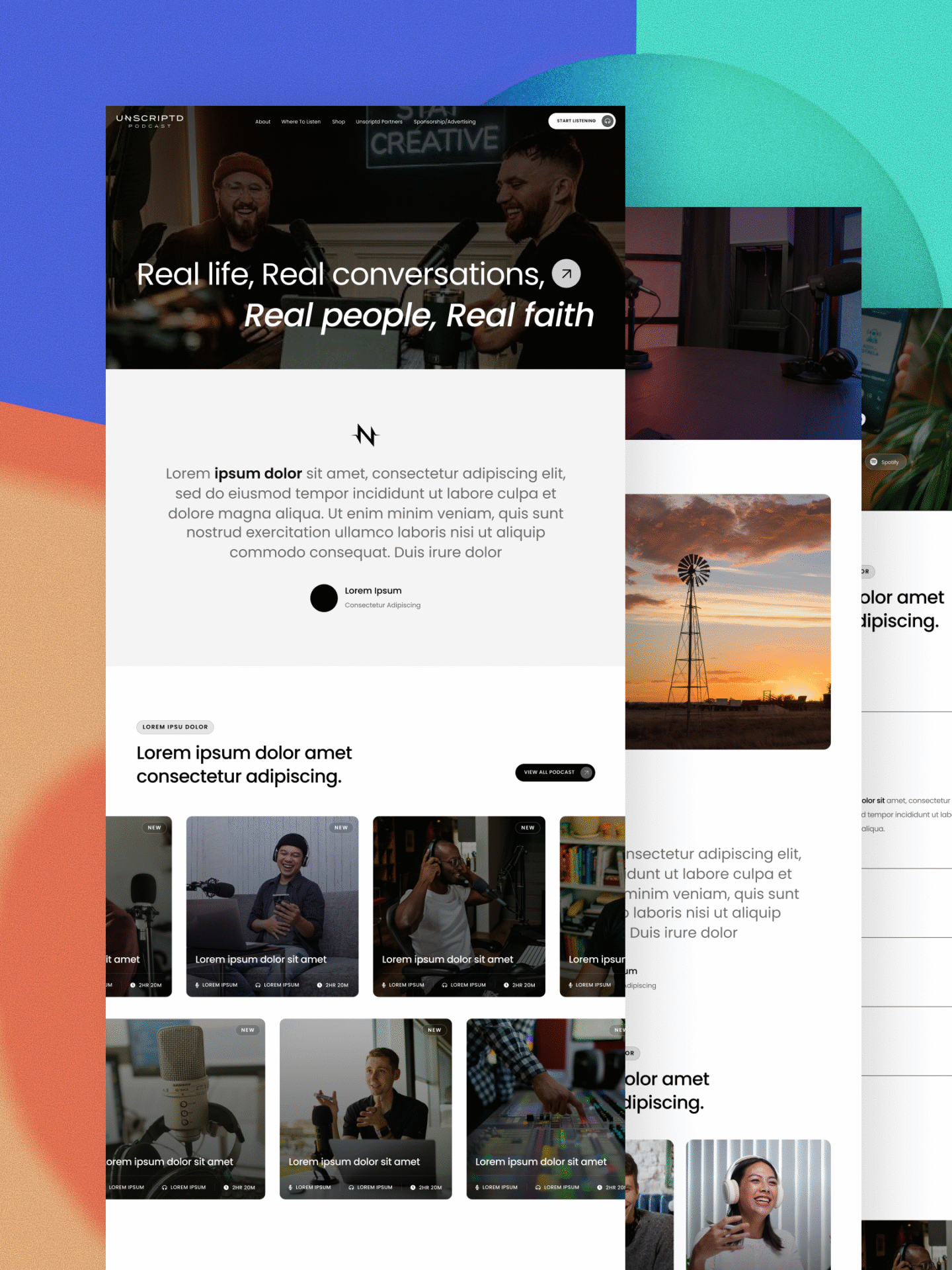

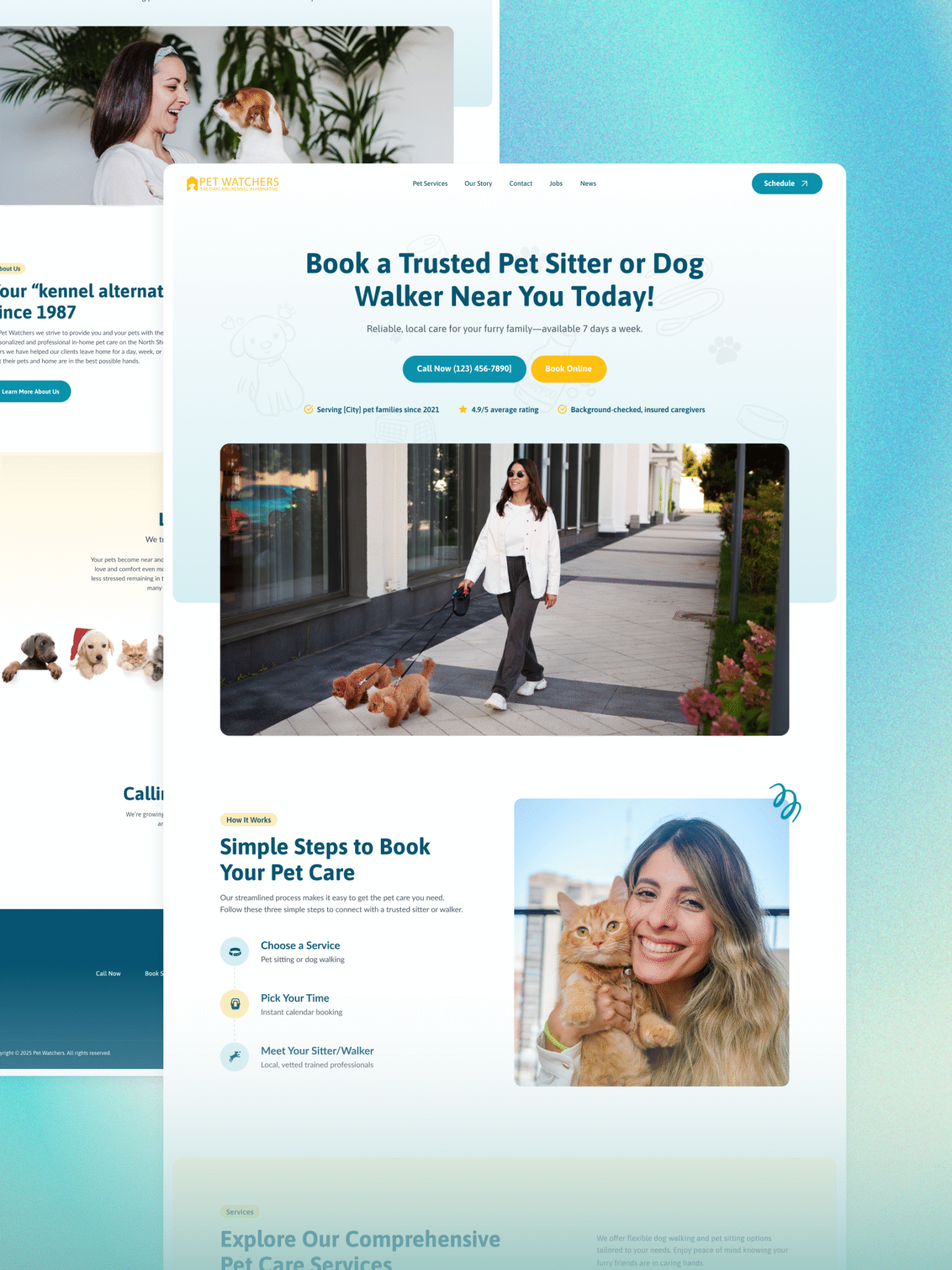

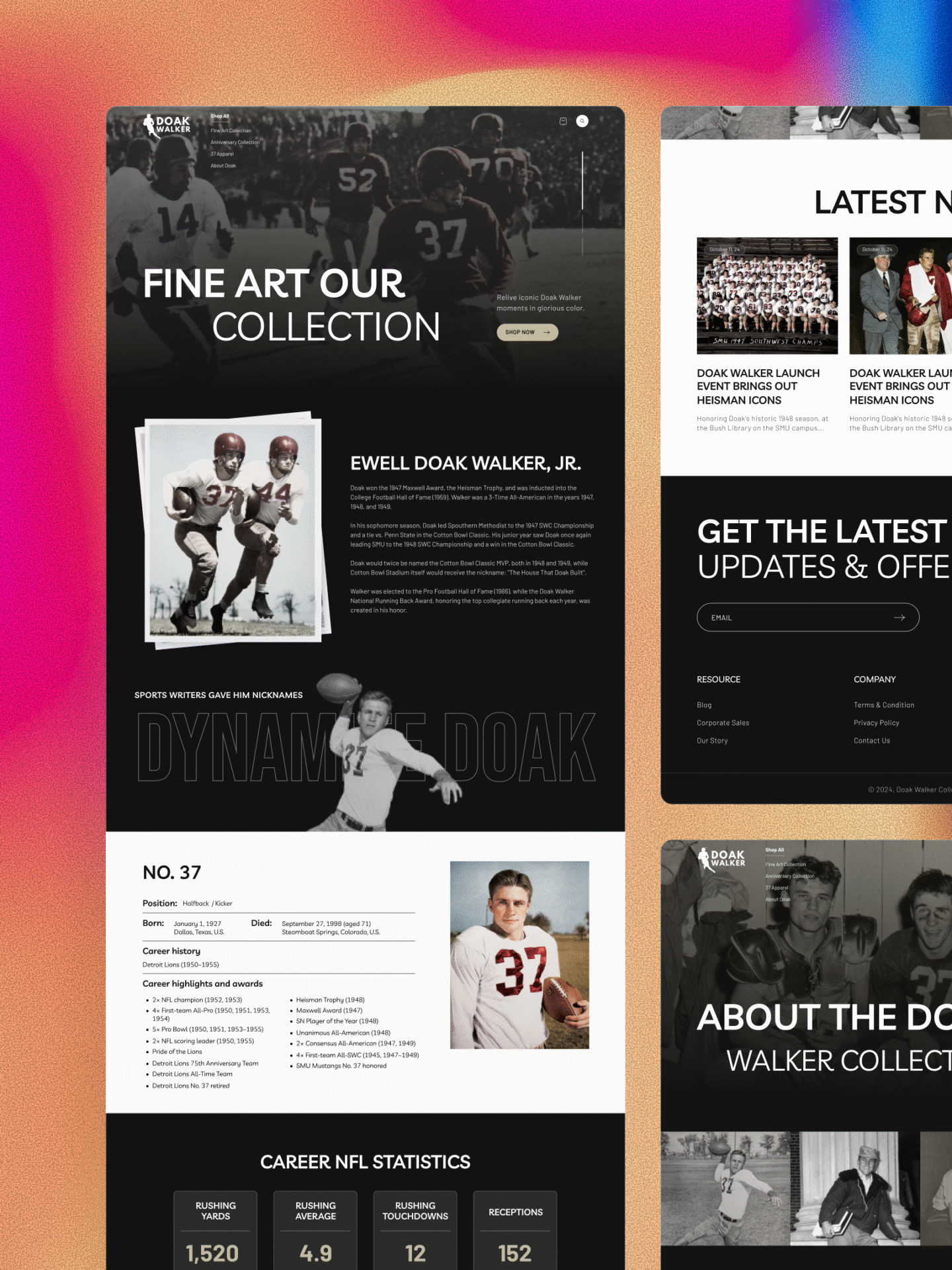

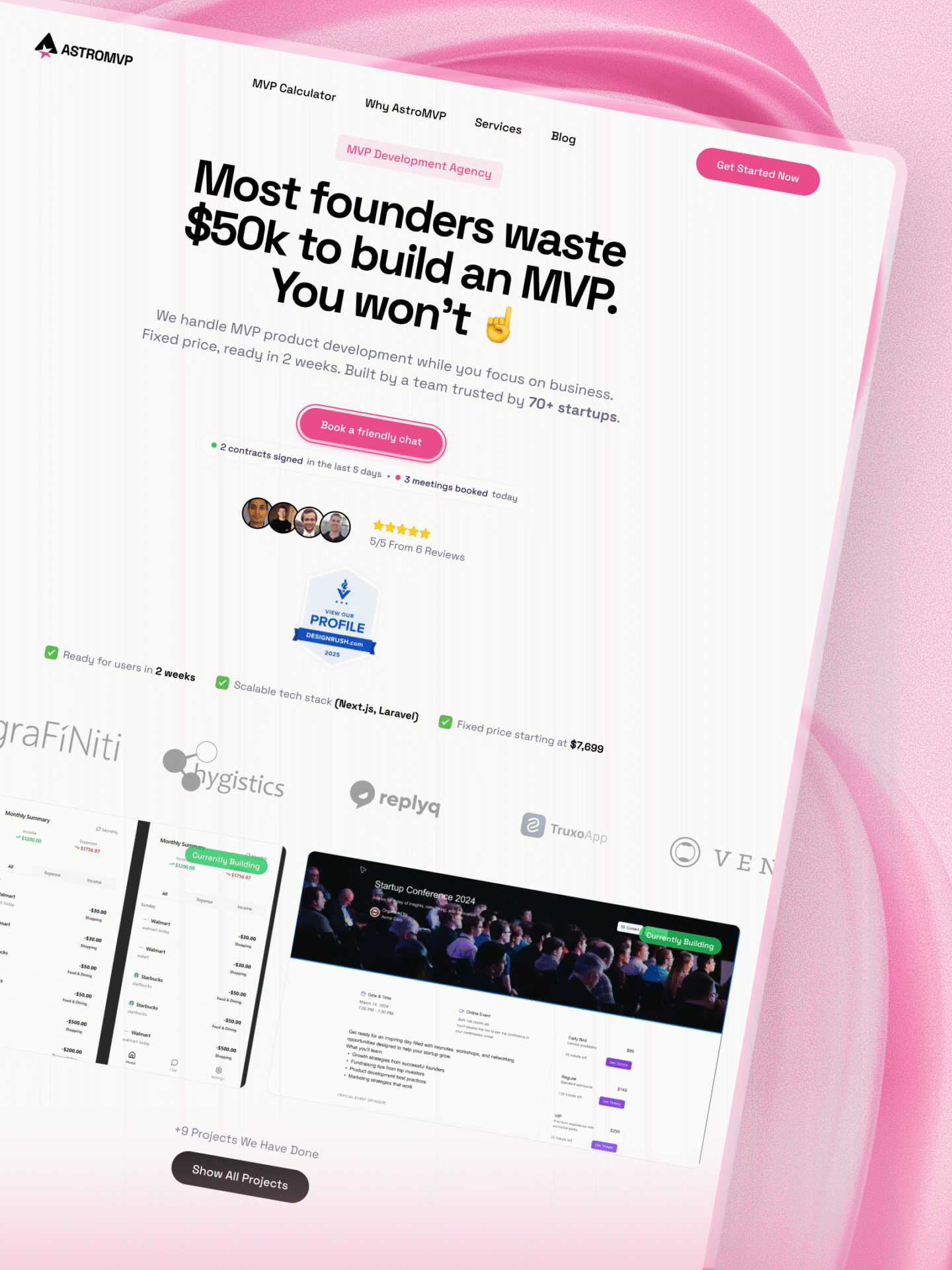

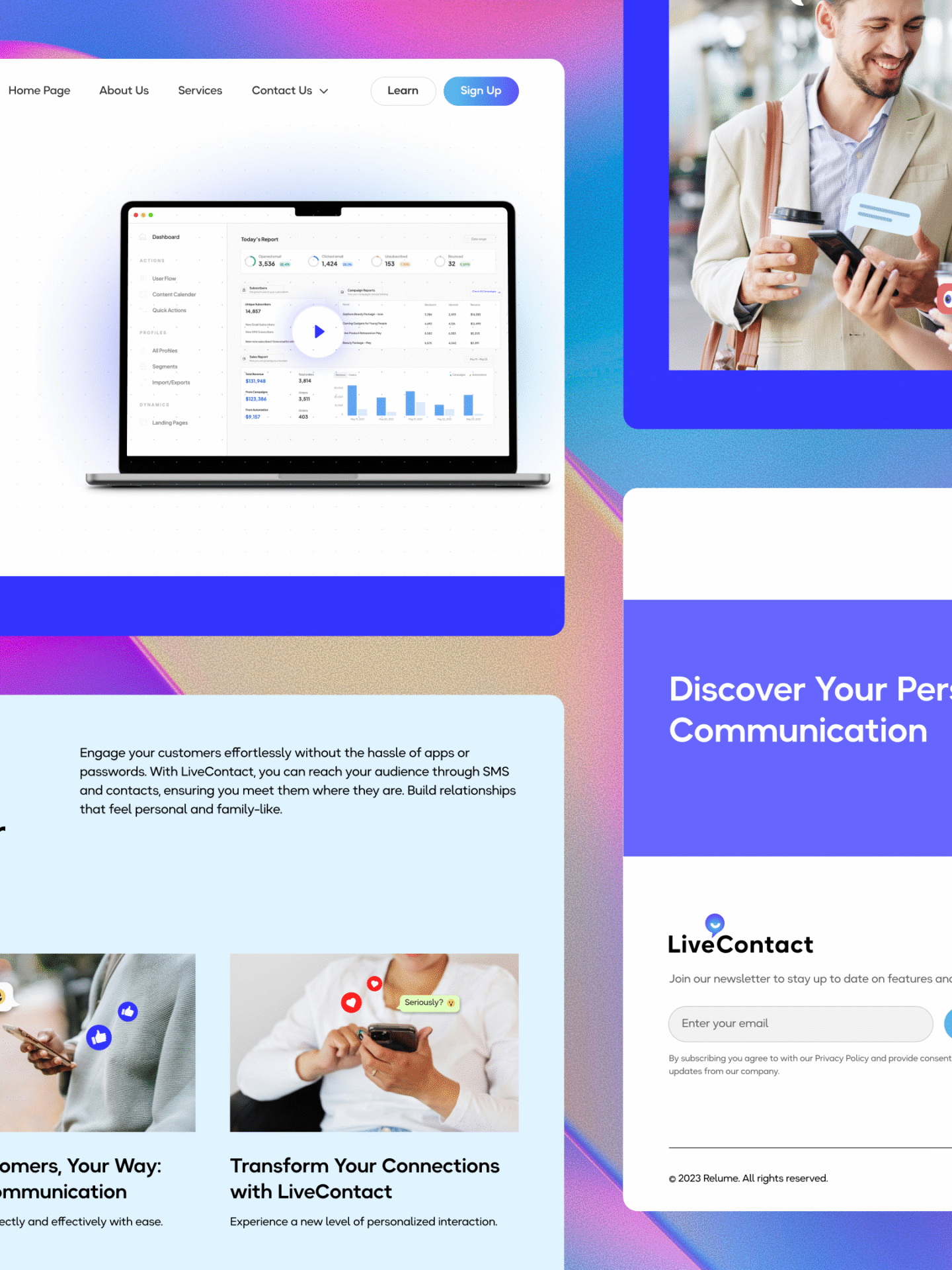

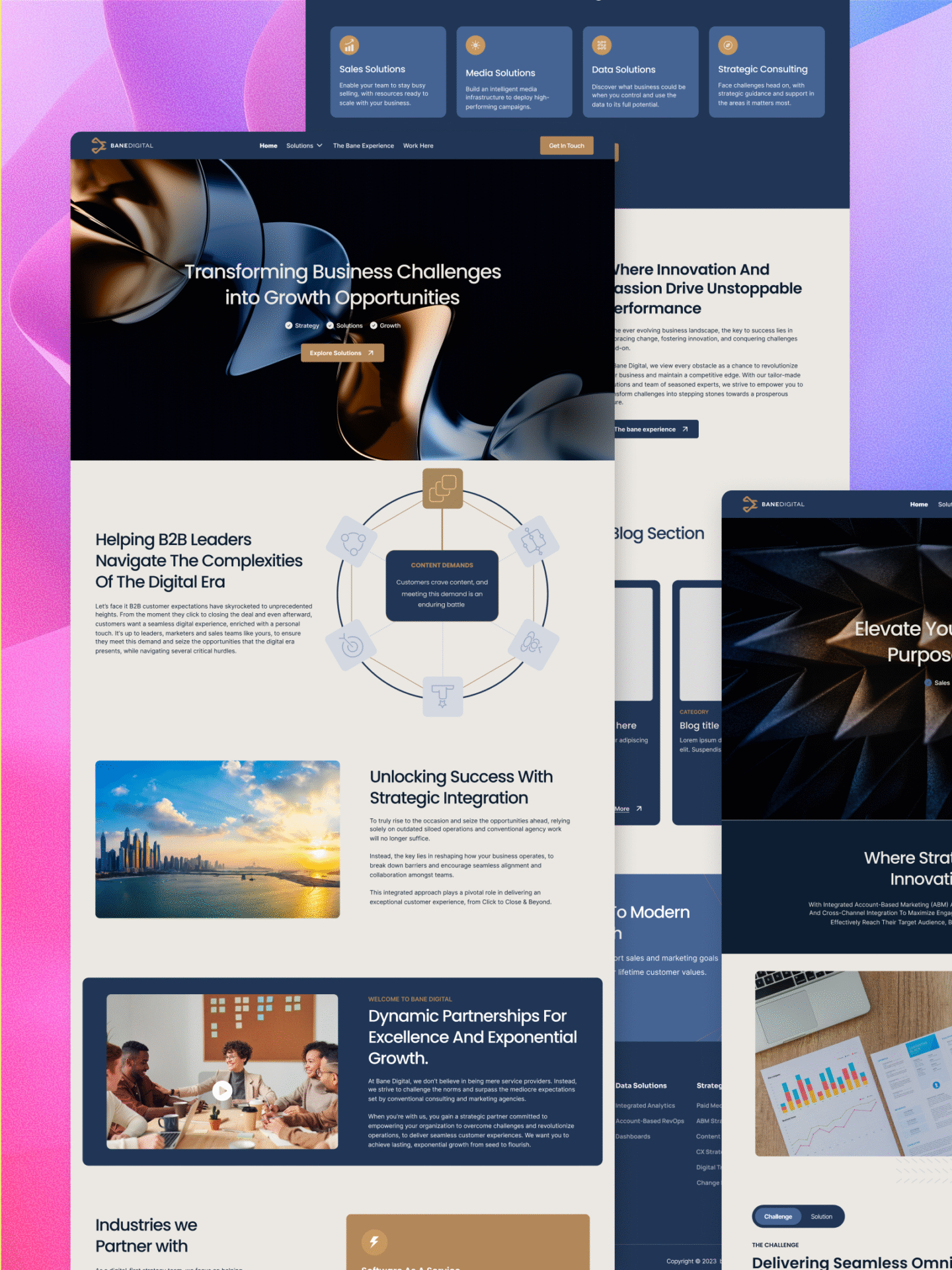

Website Design & Webflow Development

We design beautiful websites and landing pages on Figma, then handle full Webflow development, including converting your existing Figma designs to Webflow.

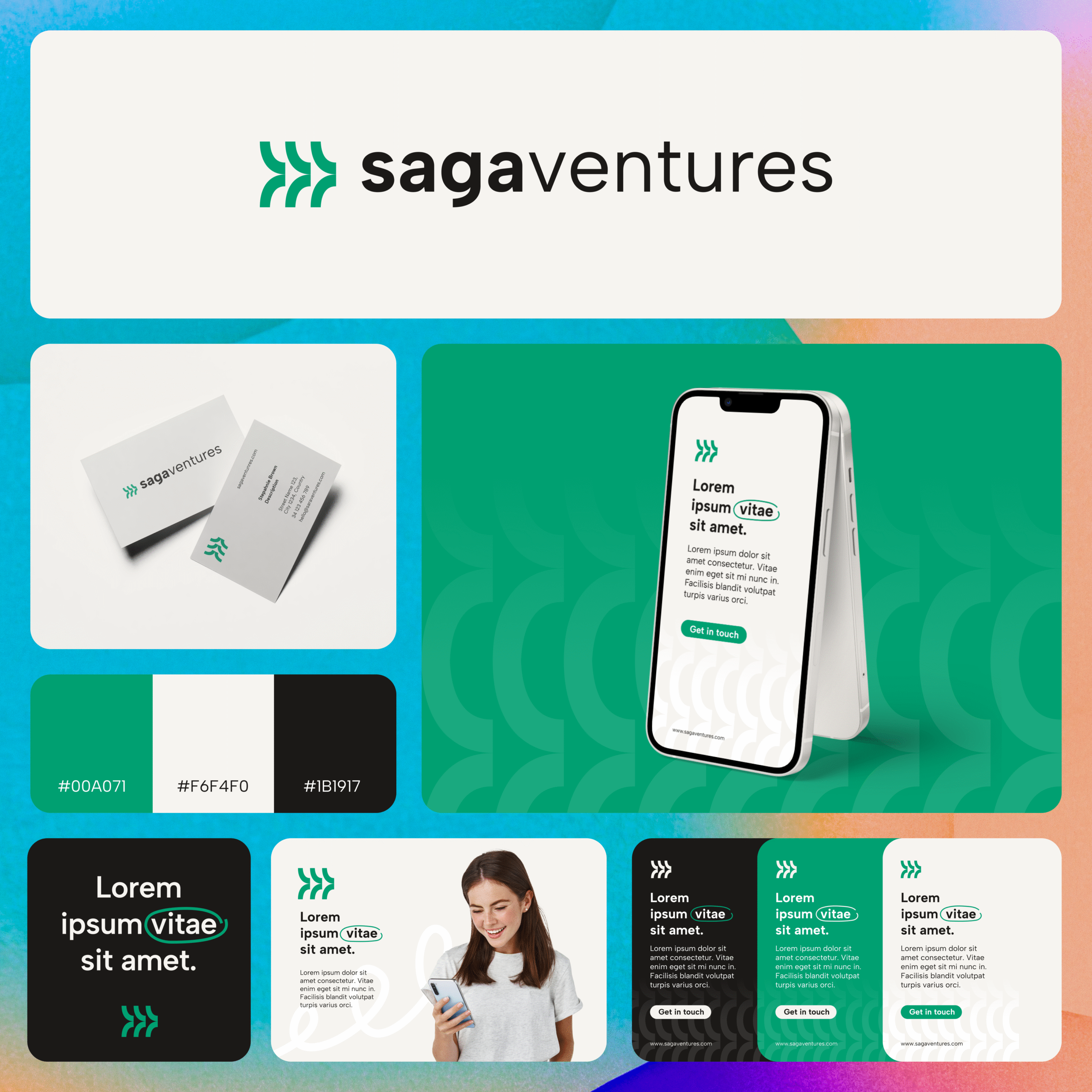

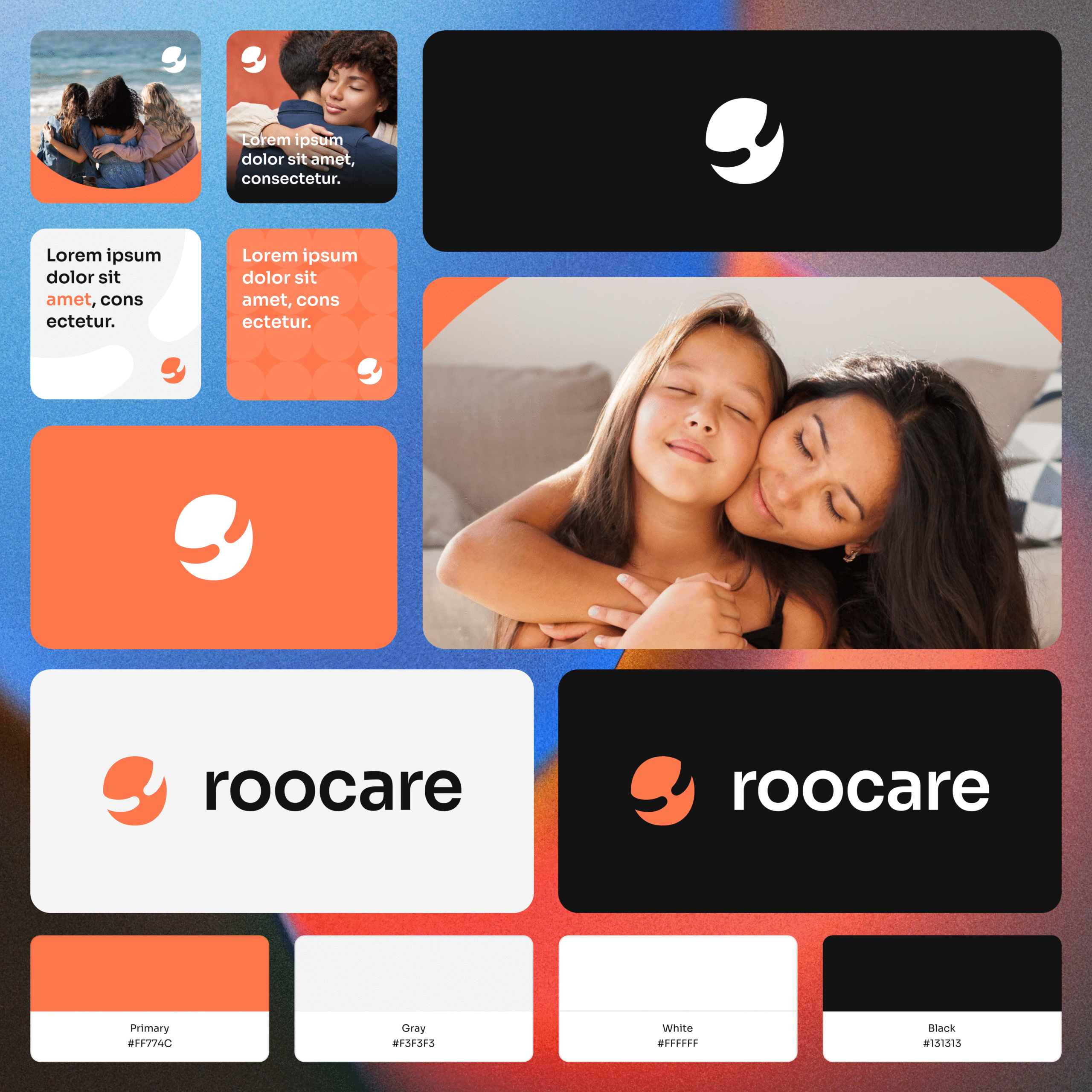

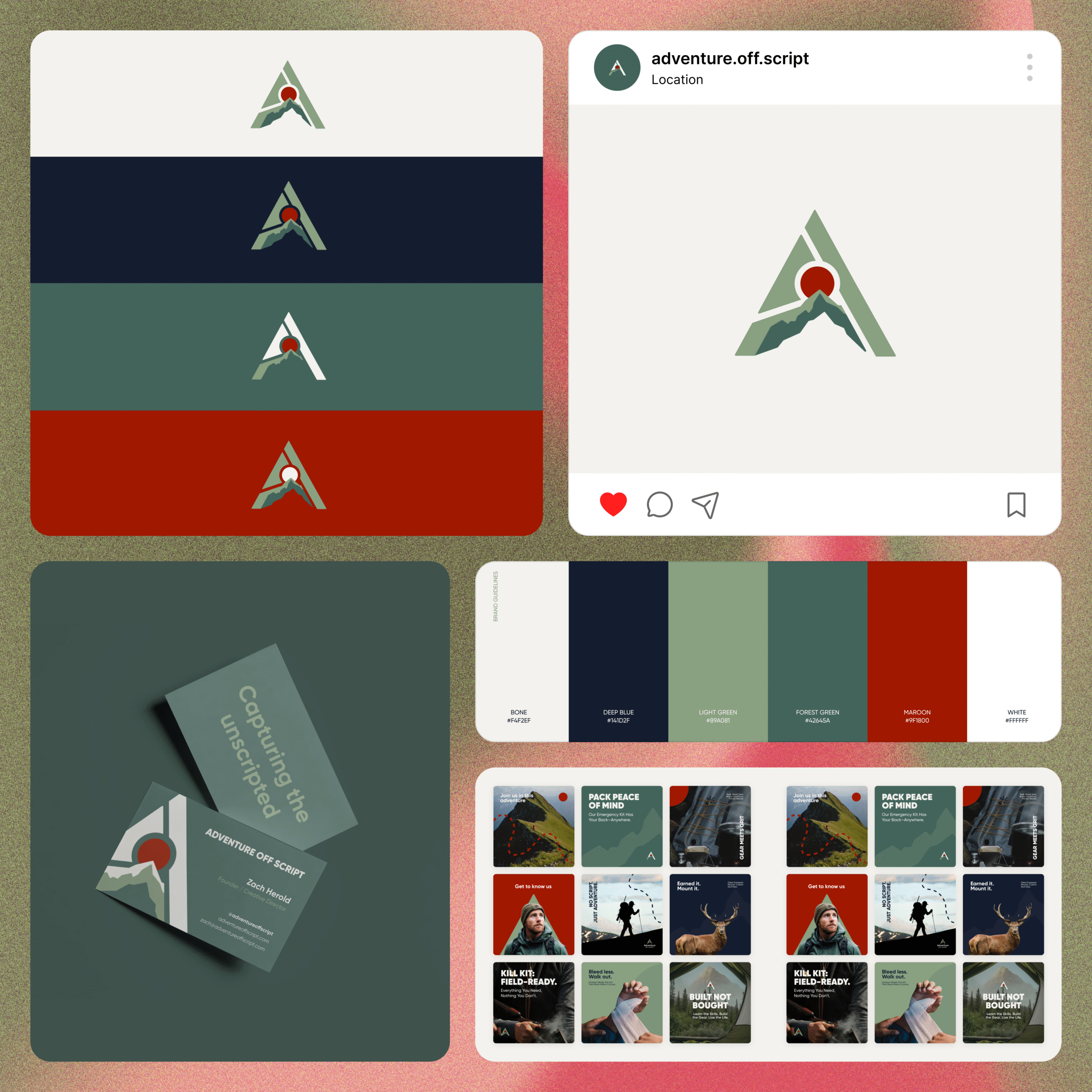

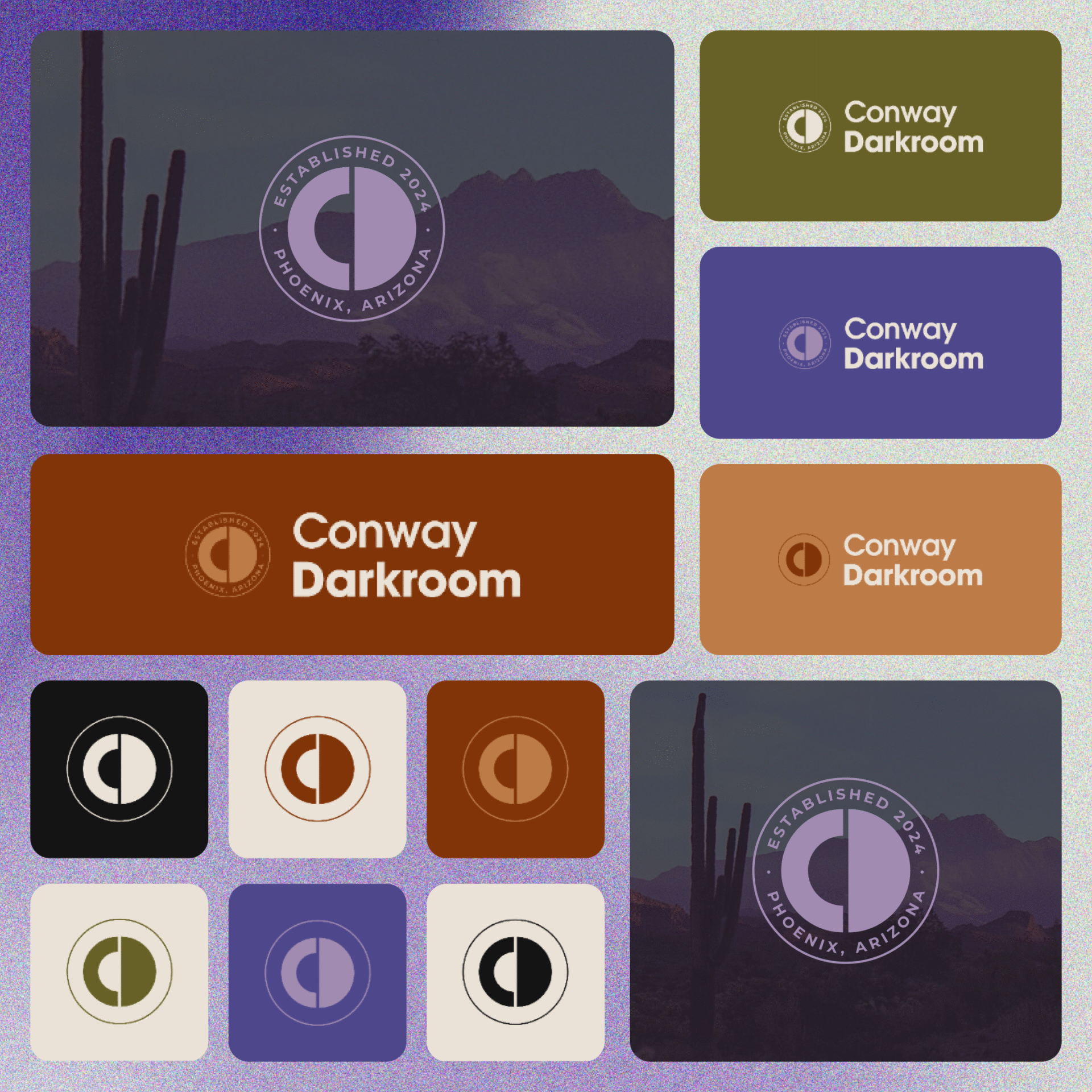

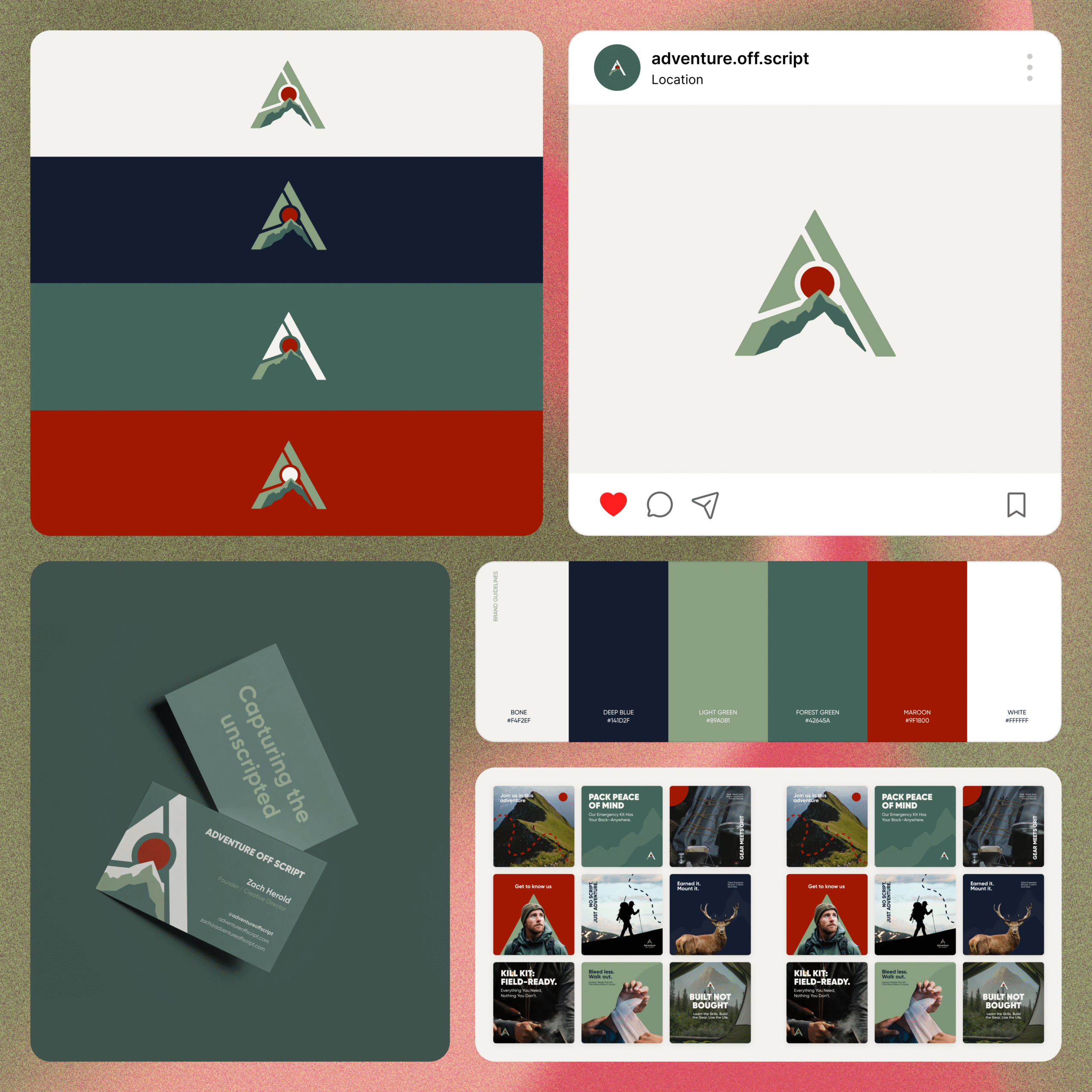

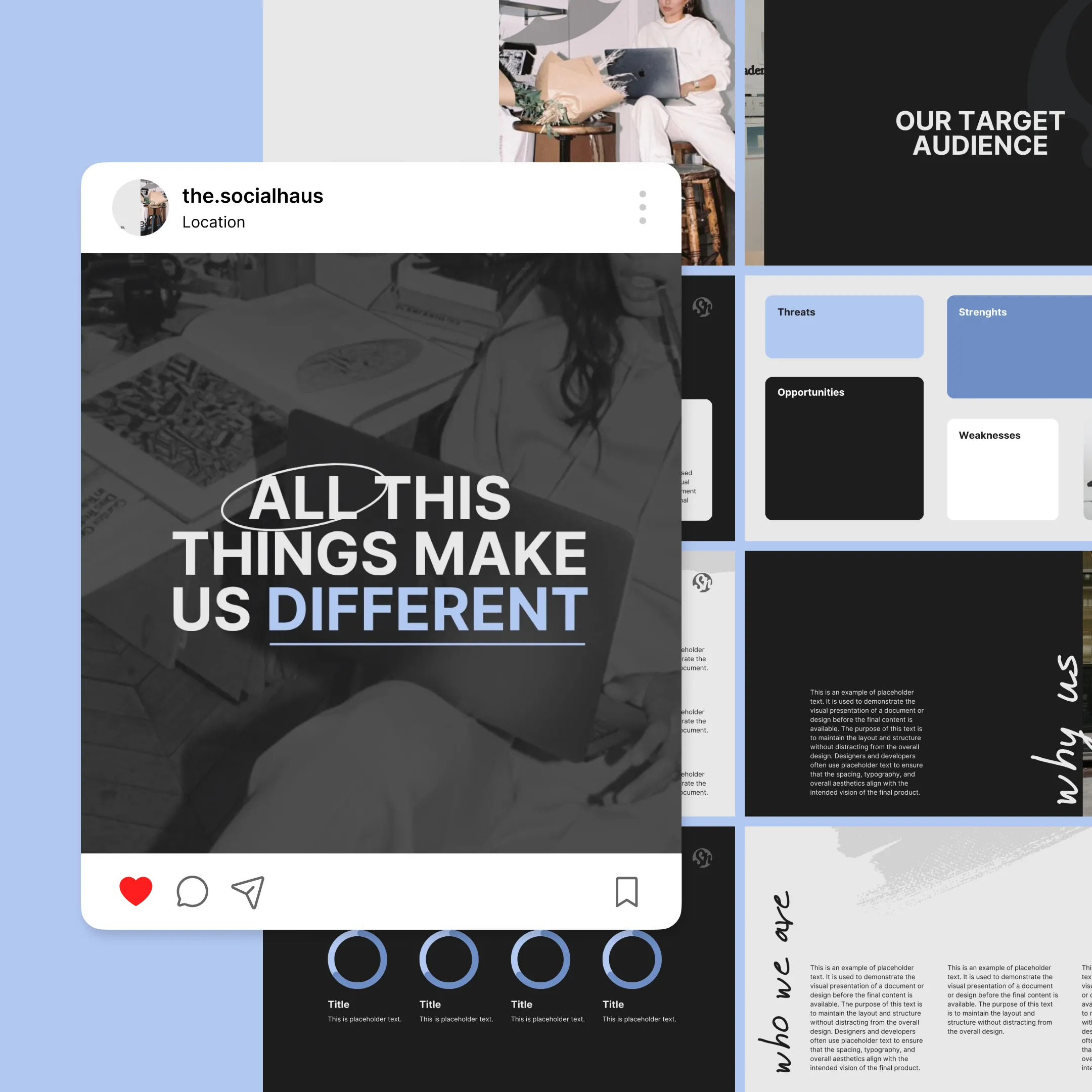

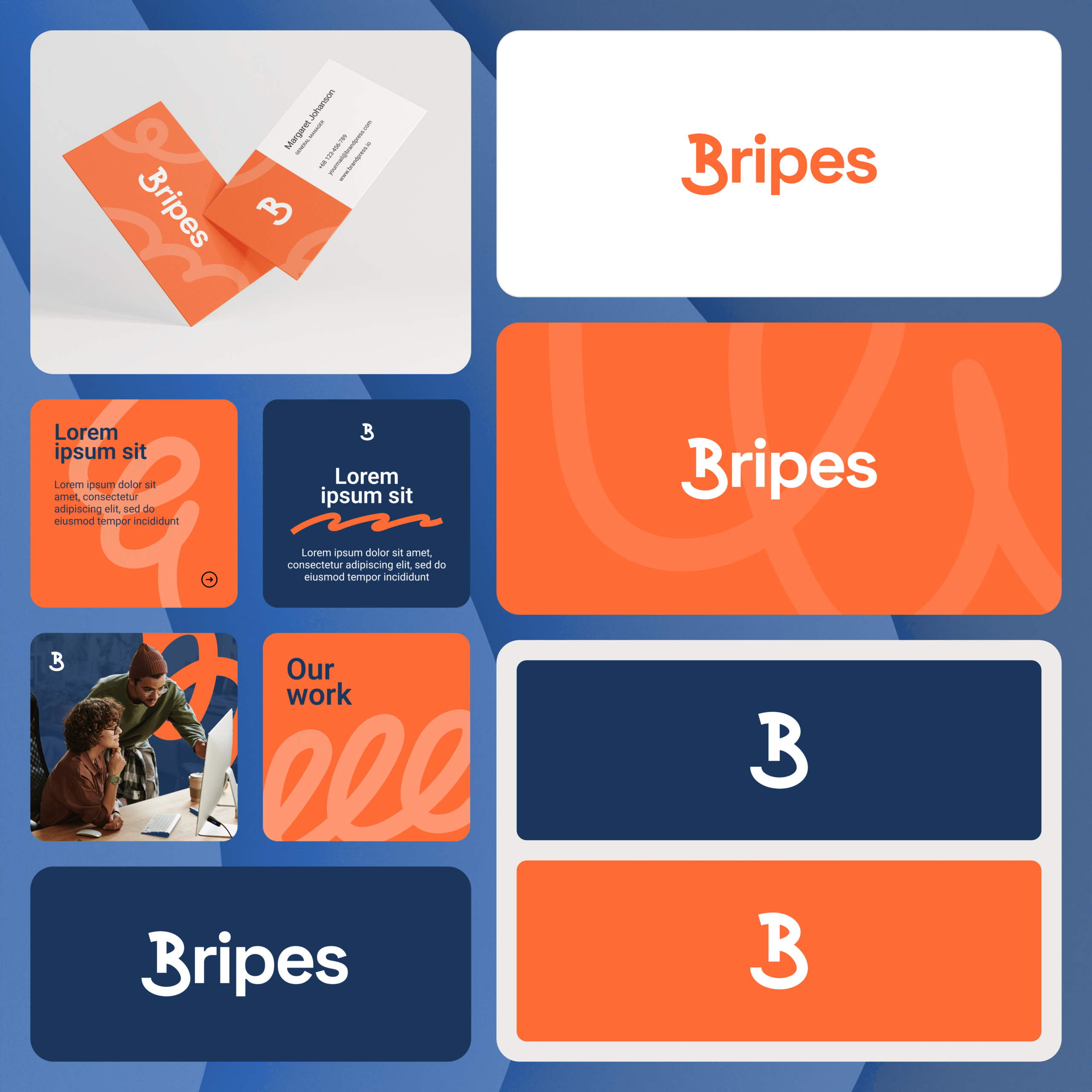

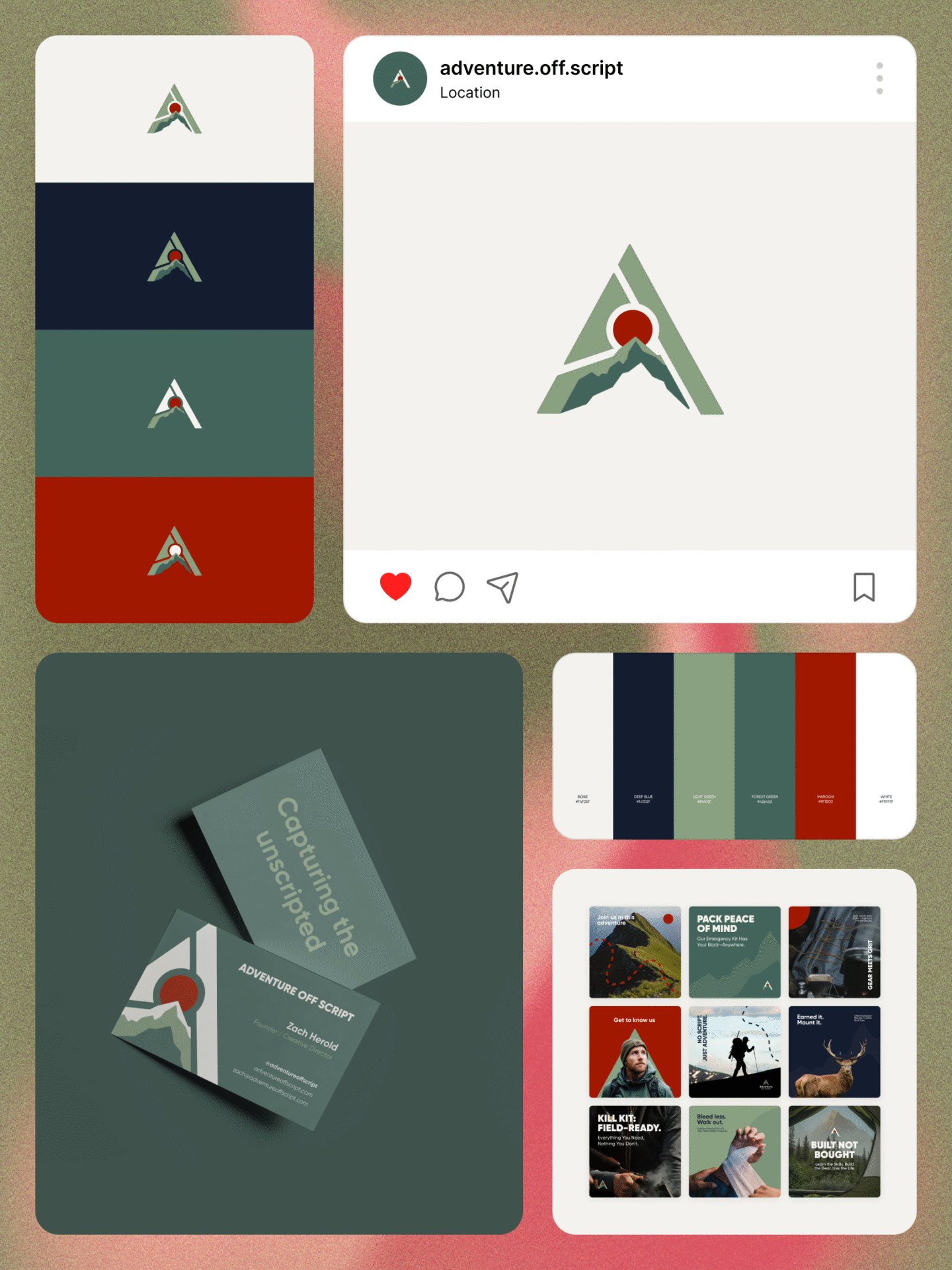

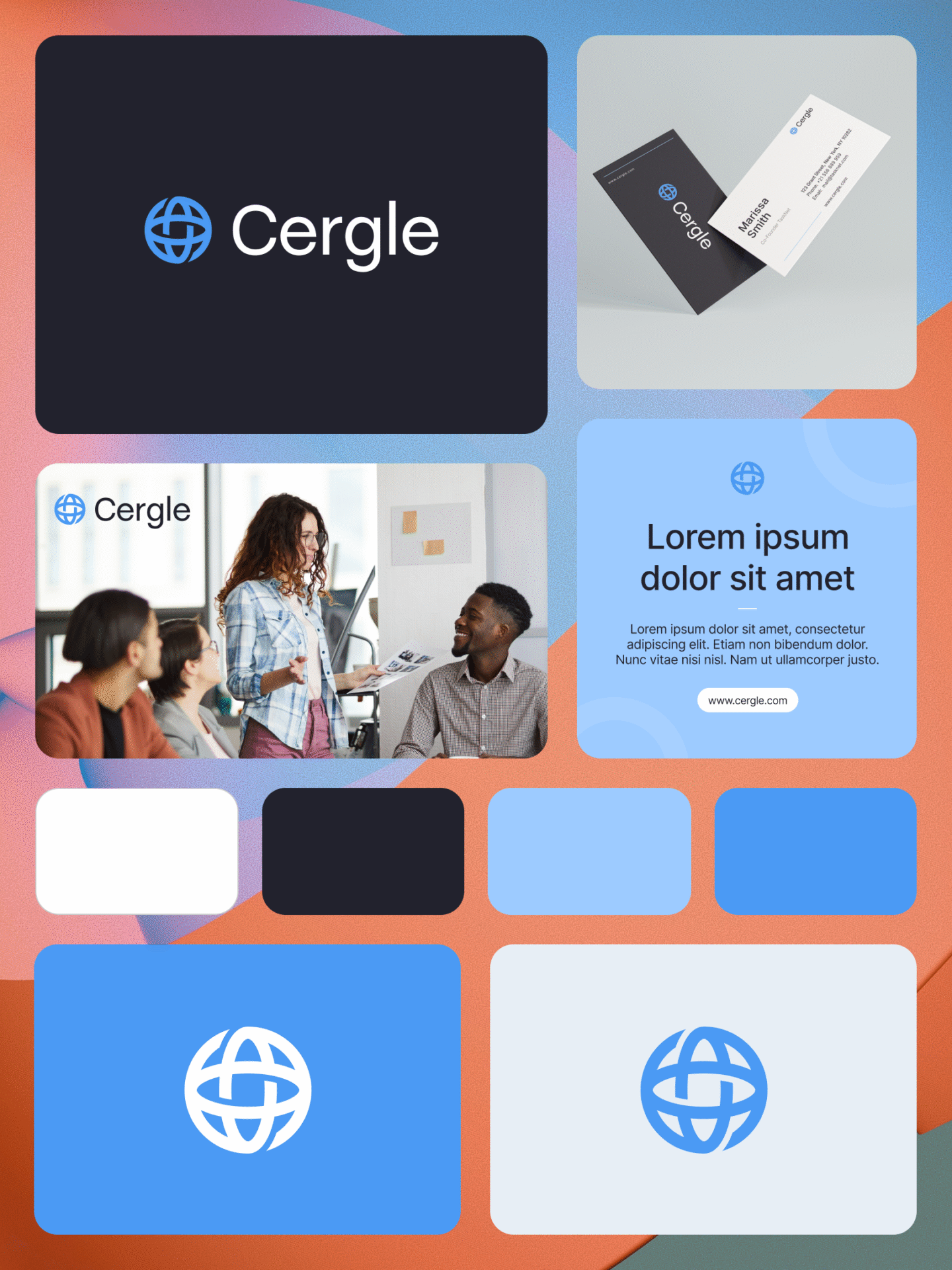

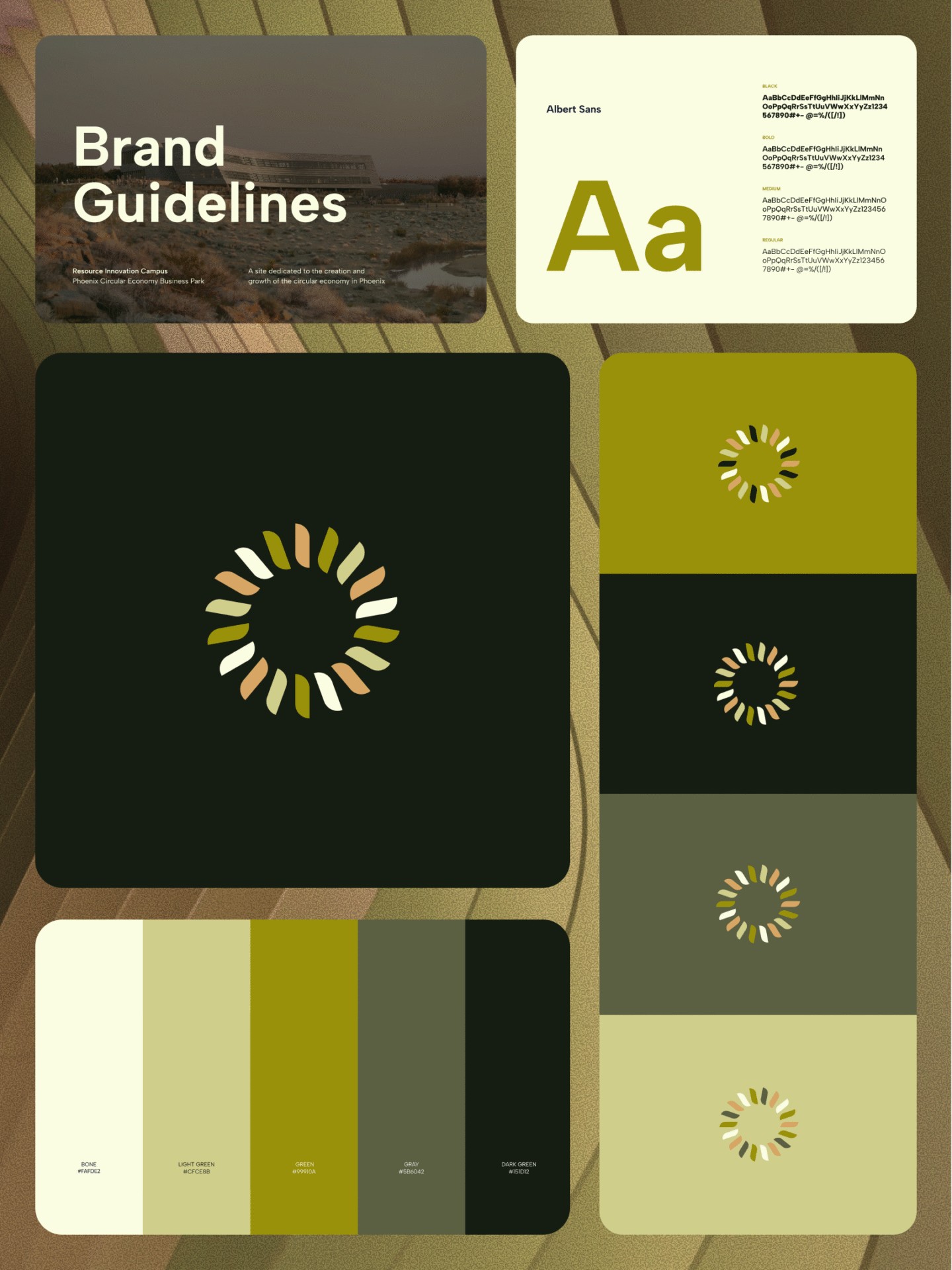

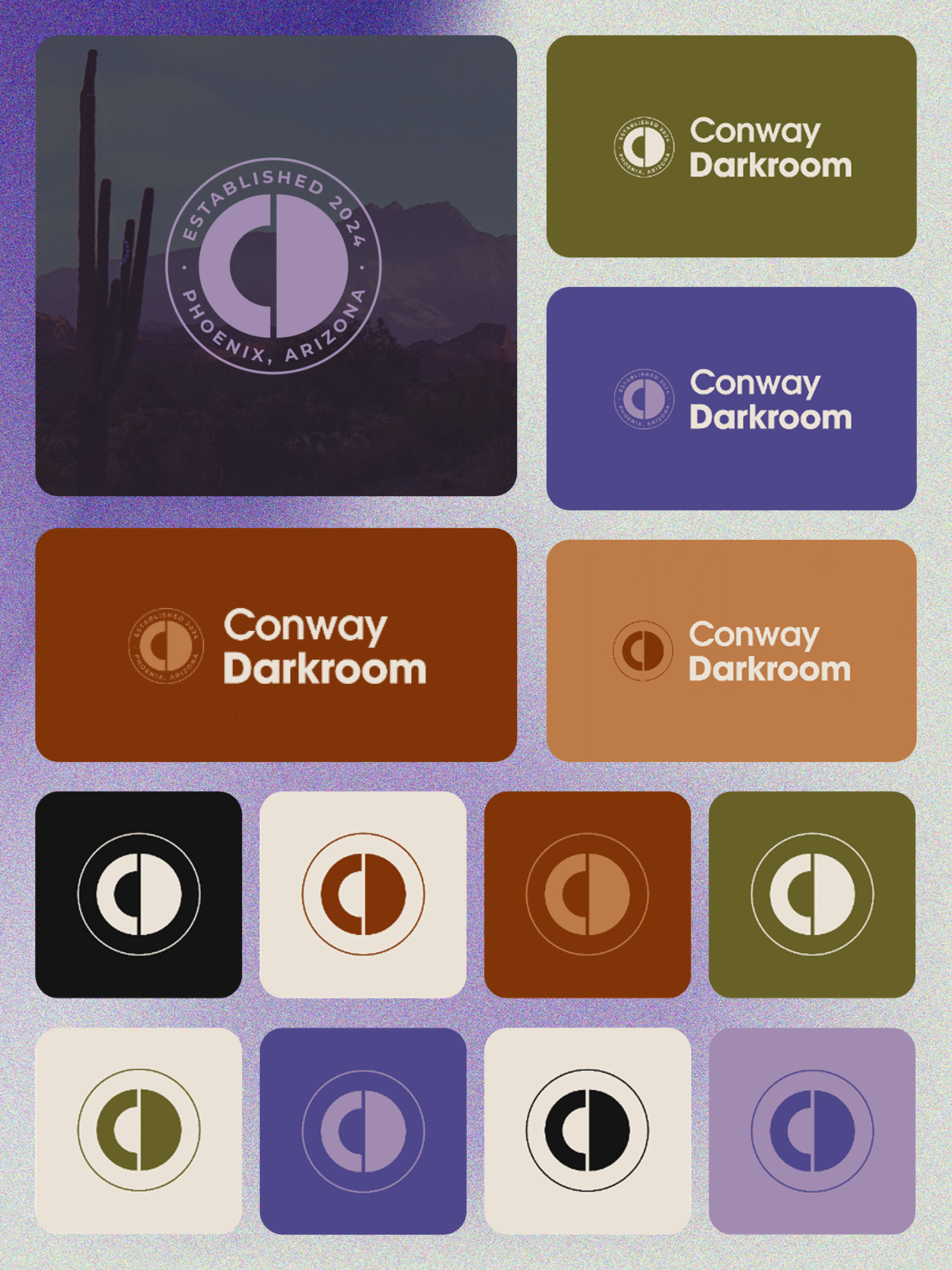

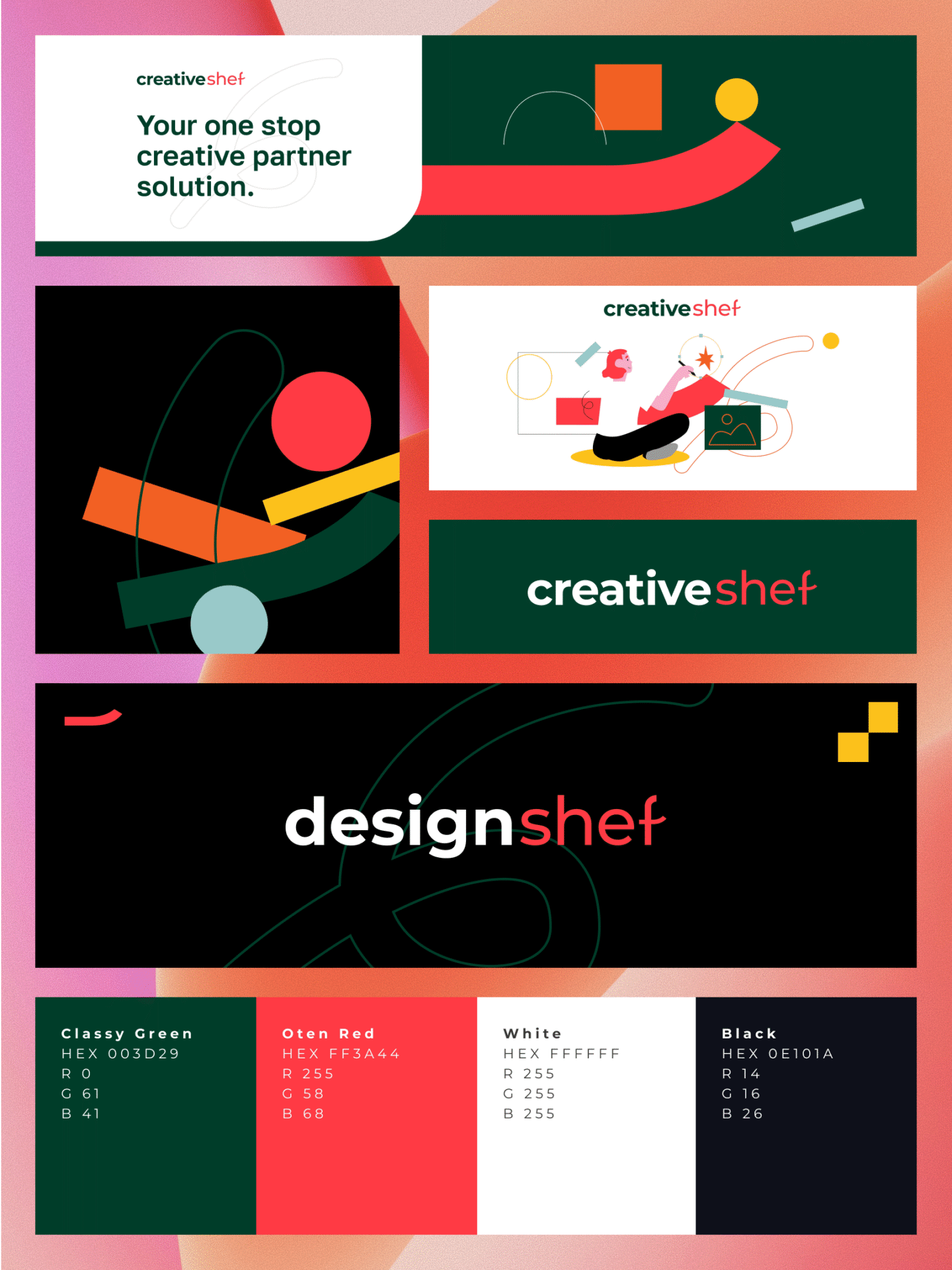

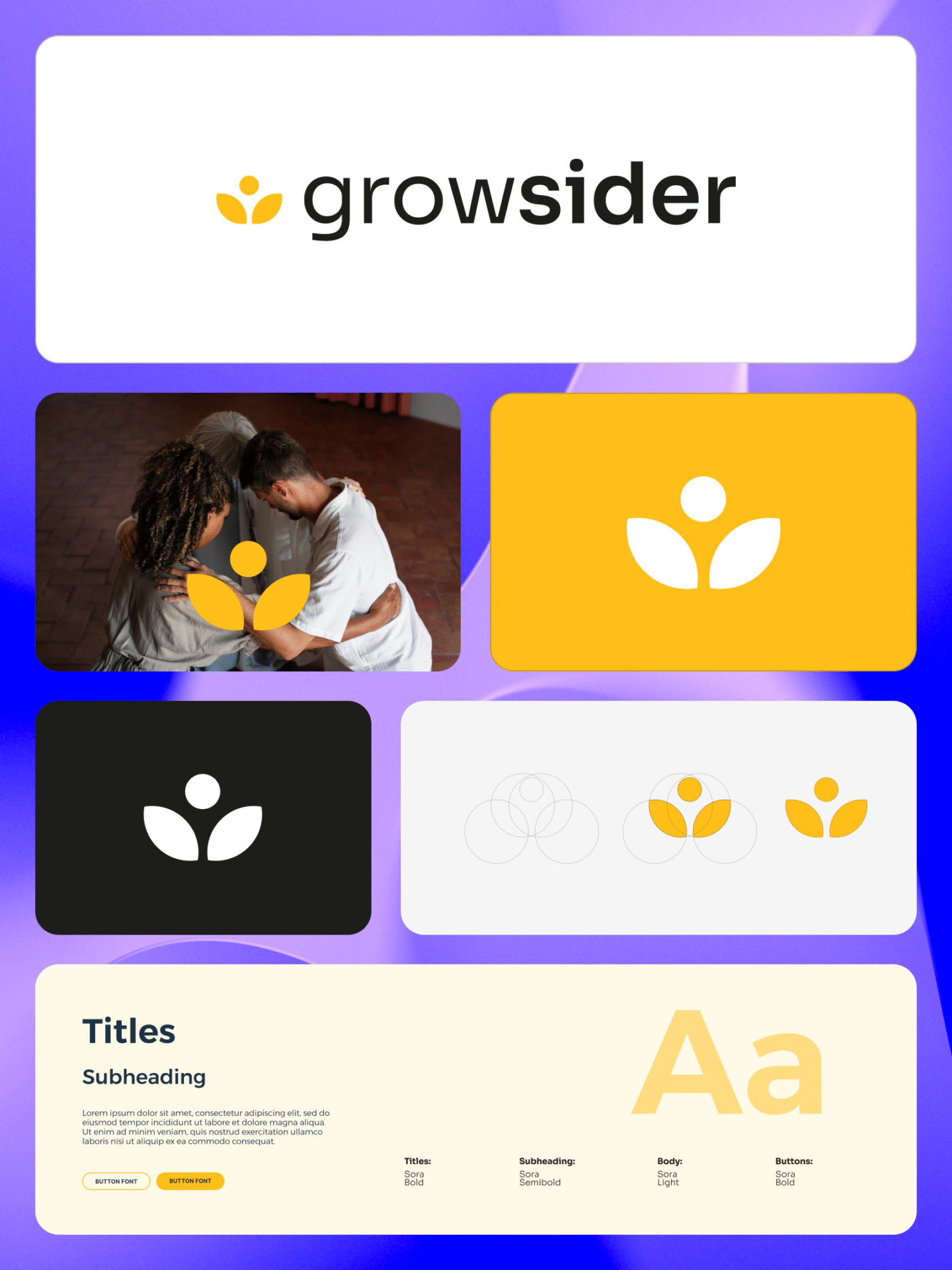

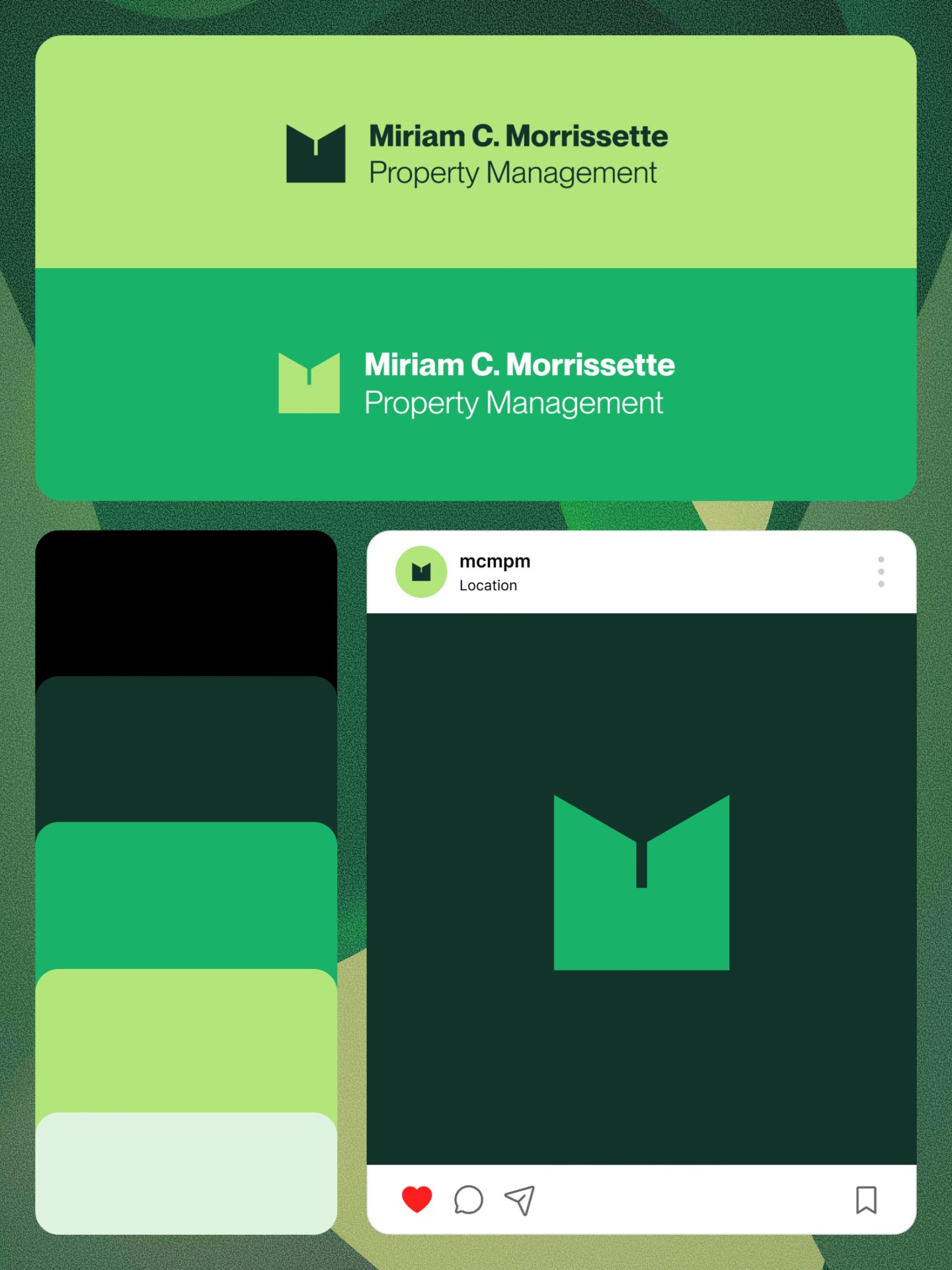

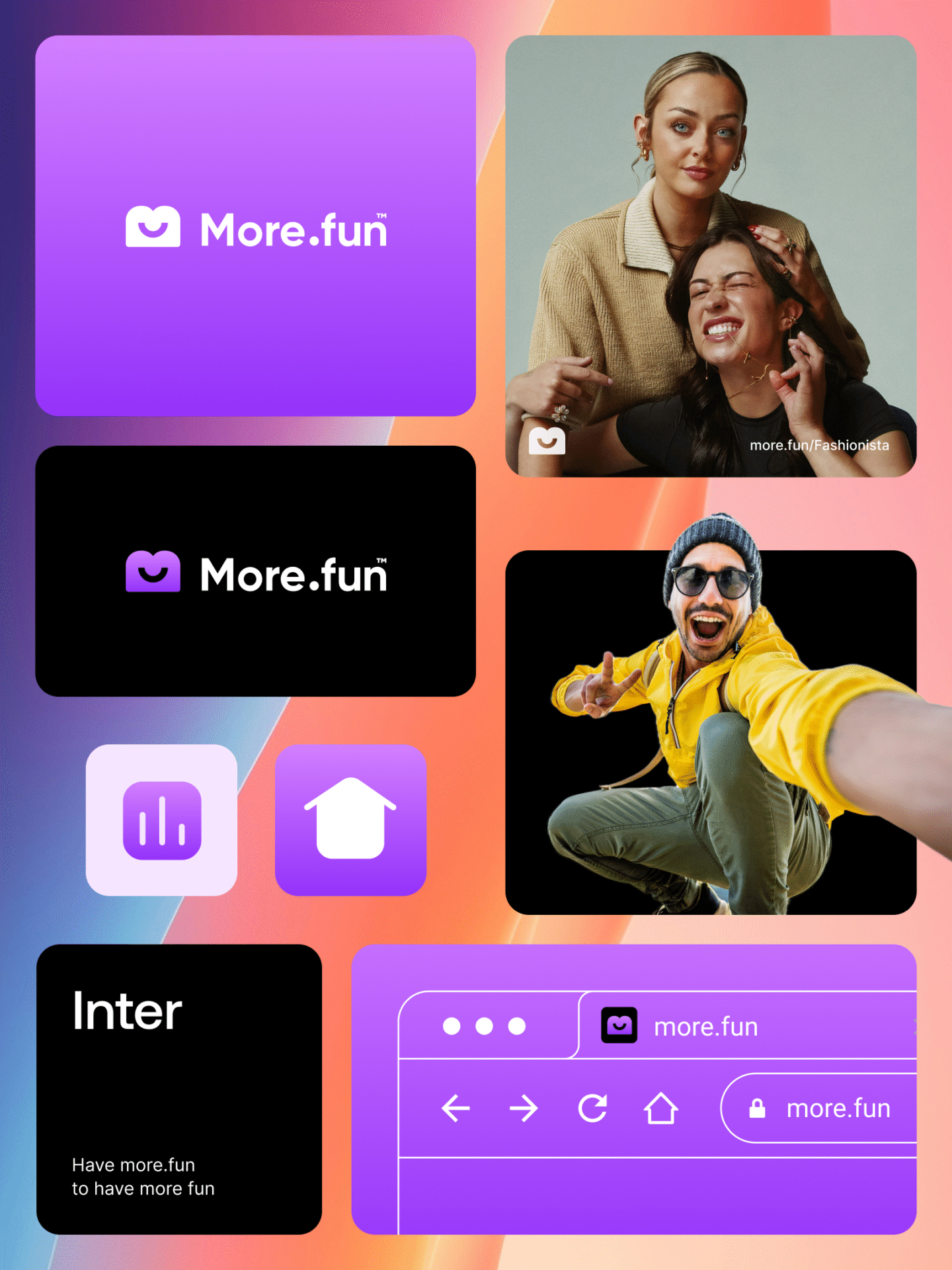

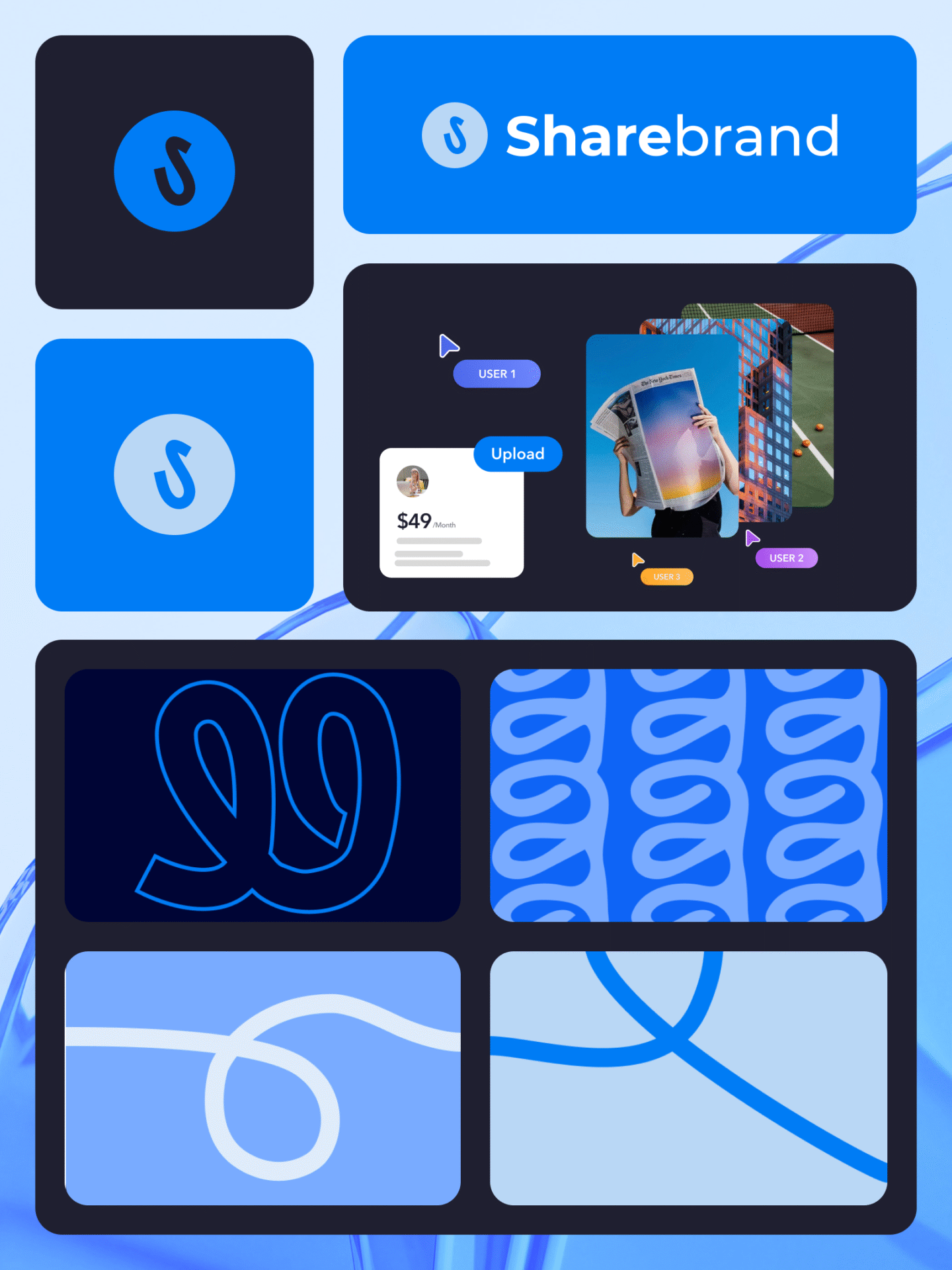

Graphic Design & Branding

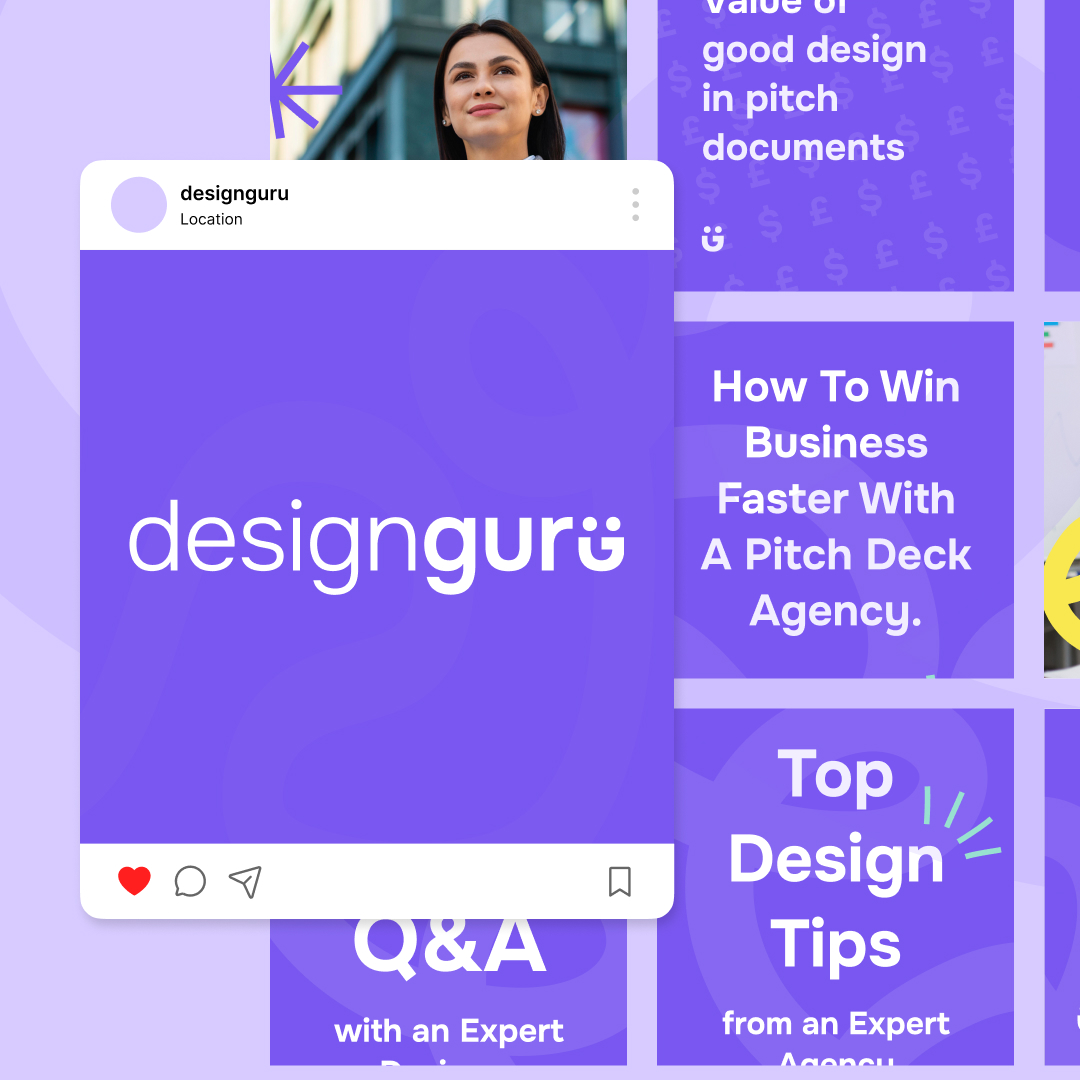

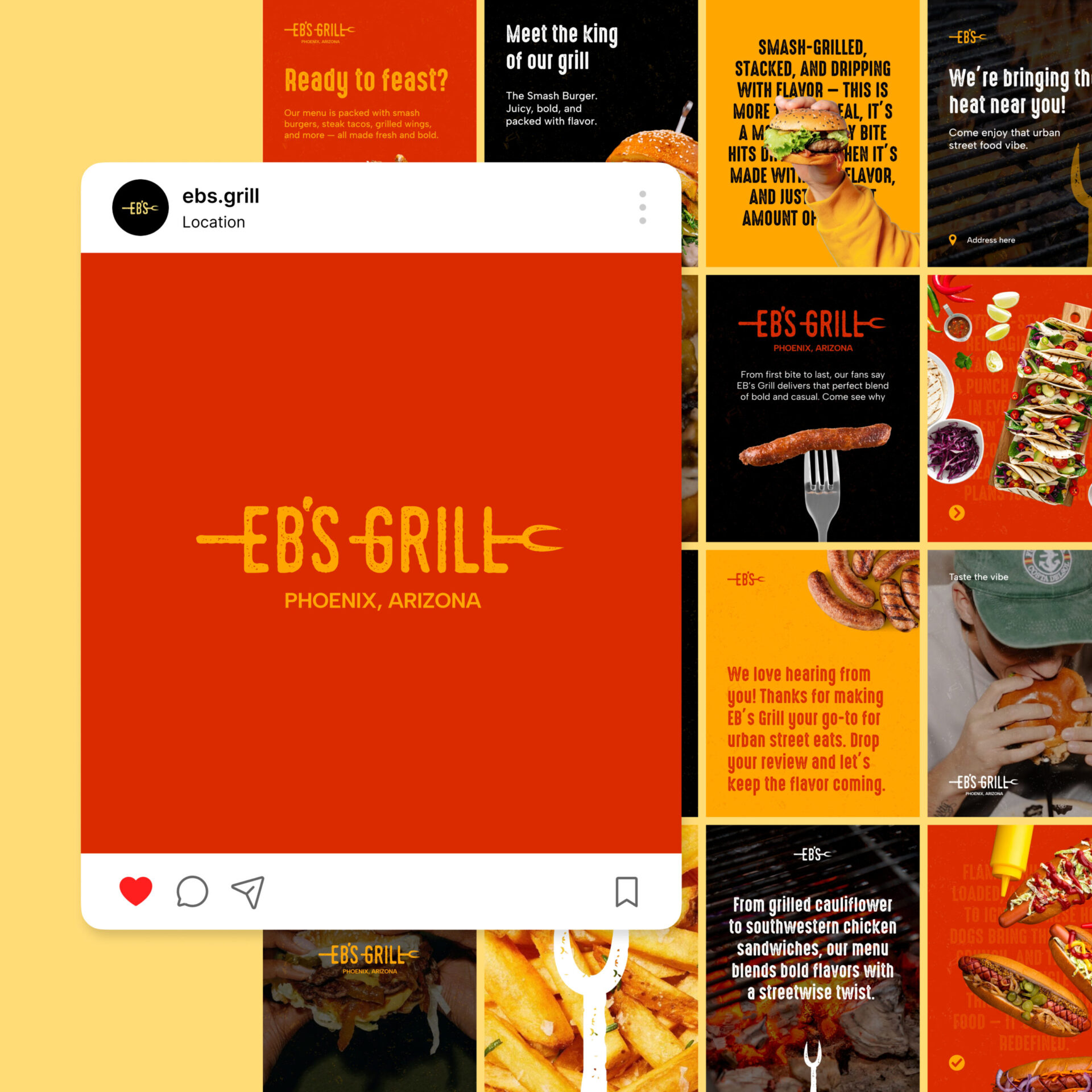

Eye-catching marketing assets: logos, branding, presentations, social media graphics, illustrations, email designs, packaging, and print materials.

Video Editing & Motion Graphics

Engaging video editing and animated graphics for social media content, product demos, promotional campaigns, including logo animations and explainer videos.

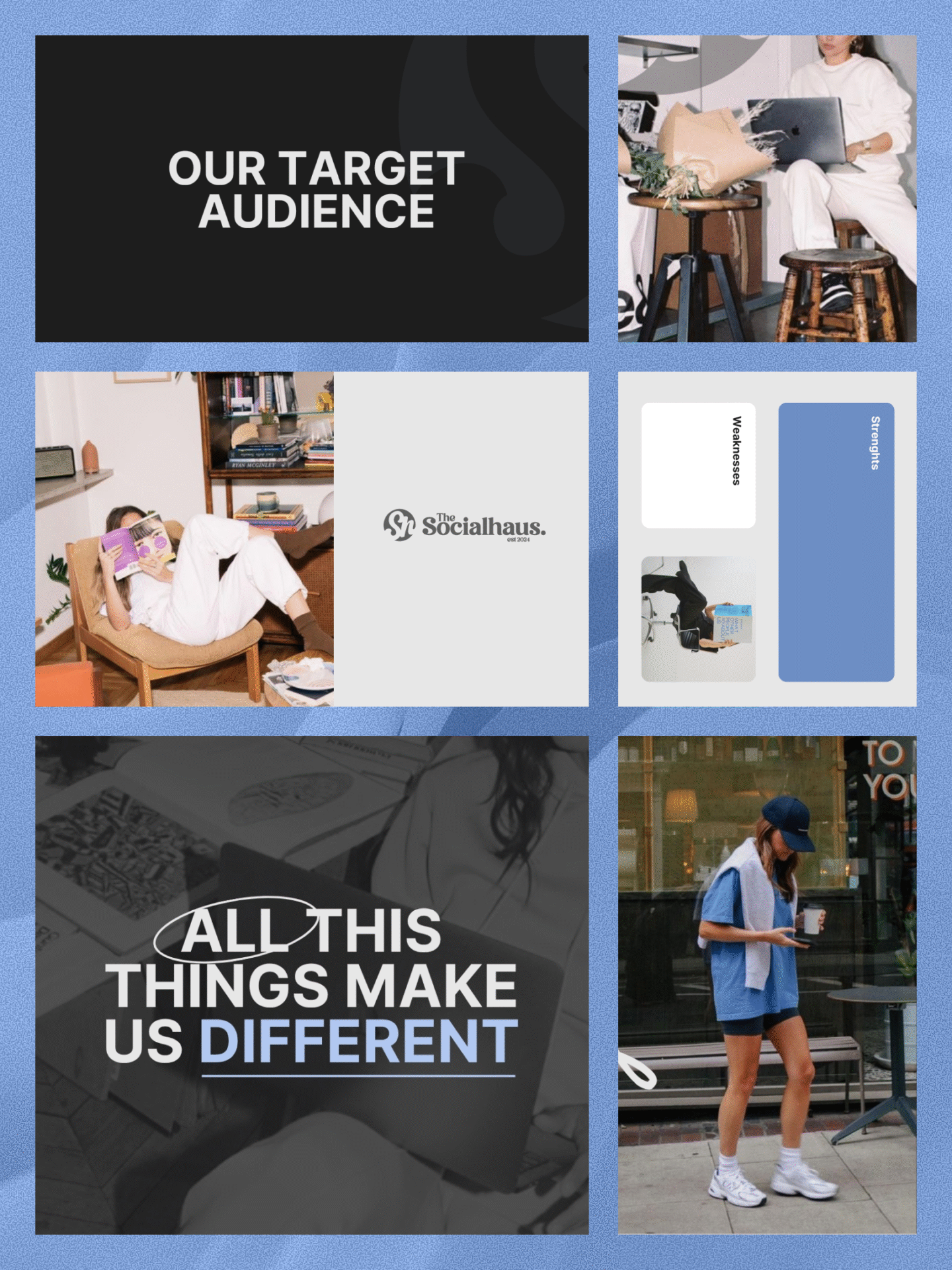

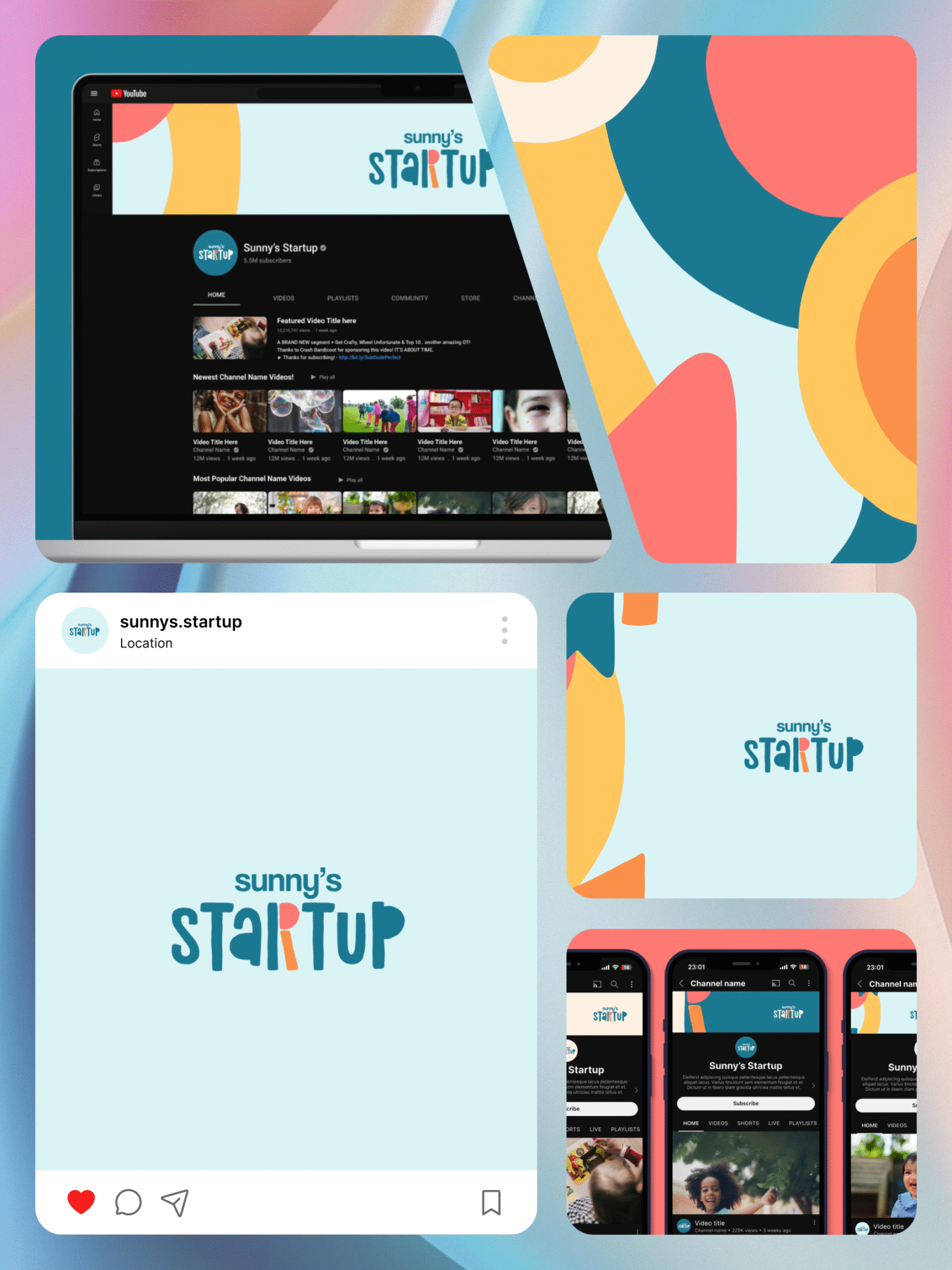

Portfolio

Recent work for businesses like yours.

Need more examples?

Why choose Reel Unlimited

Dedicated design teams

Work with professional designers and developers who understand your business needs and deliver consistent quality.

Fast, reliable delivery

Graphics and branding in 48 hours, websites in 3-5 days. No waiting weeks for freelancers or agencies to respond.

Budget friendly

Simple, predictable and affordable pricing designed for every business budget. Start with a one-week risk-free trial.

No hiring headaches

Skip the time and cost of recruiting, hiring, and managing in-house designers or unreliable freelancers.

Full ownership guaranteed

You own 100% of everything we create - all design files, source files, and complete copyright transfer included.

No contracts, cancel anytime

No contracts, pause or cancel anytime. Scale up when busy, pause when you don't need us, no surprises.

Simple plans and pricing

Choose the perfect plan for your design needs. All plans include unlimited requests, fast delivery, and unlimited revisions.